IBM shares rose 3% in prolonged buying and selling on Tuesday after the expertise providers firm issued first-quarter outcomes that beat expectations.

This is how the corporate did:

- Earnings: $1.40 per share, adjusted, vs. $1.38 per share as anticipated by analysts, in accordance with Refinitiv.

- Income: $14.2 billion, vs. $13.85 billion as anticipated by analysts, in accordance with Refinitiv.

Income within the interval rose 7.7% from a 12 months earlier, IBM stated in a press release. That is the corporate’s first full quarter with out the managed infrastructure providers enterprise it spun off into an entity known as Kyndryl. Gross sales to Kyndryl added 5 share factors to income progress within the quarter. However Kyndryl will not be delivering progress after October, CEO Arvind Krishna stated on a name with analysts.

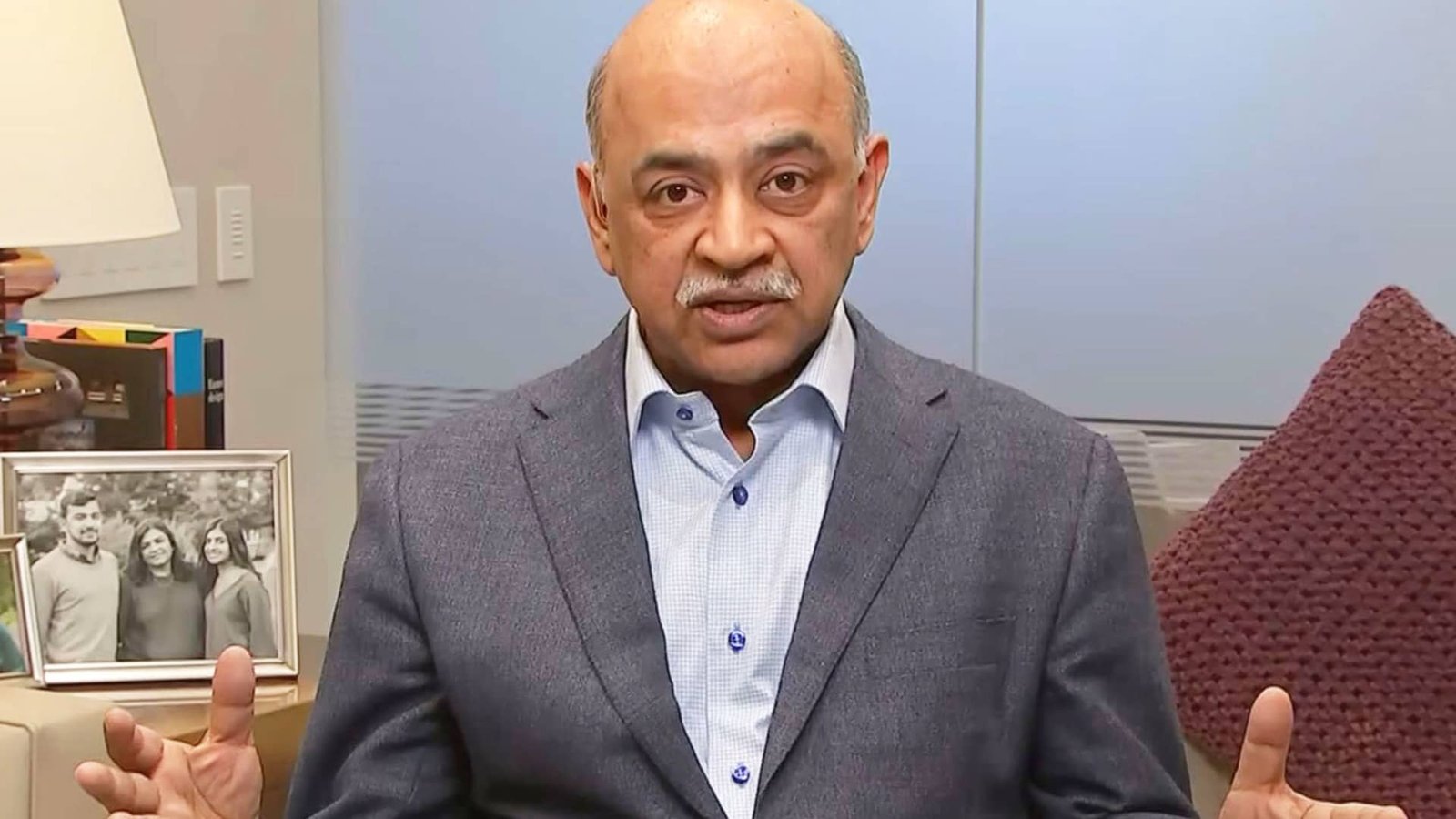

IBM CEO Arvind Krishna

Supply: CNBC

Internet earnings from persevering with operations jumped 64% from a 12 months earlier to $662 million. General web earnings declined 23%.

IBM raised its full-year steerage, calling for income progress in fixed forex within the excessive finish of its mid-single-digit vary, with a further 3.5 share factors of progress from Kyndryl. In January the executives informed analysts to count on mid-single-digit progress, not together with influence from Kyndryl or forex.

Within the first quarter, IBM’s software program section generated $5.77 billion in income, which was up 12% and above the $5.63 billion consensus amongst analysts surveyed by StreetAccount.

Consulting income rose 13% to $4.83 billion, increased than the $4.6 billion StreetAccount consensus.

Income from infrastructure fell 2% to $3.22 billion, as purchasers put together for IBM’s next-generation mainframe laptop later this 12 months.

Additionally throughout the quarter, IBM stated Francisco Companions agreed to purchase its Watson health-care information and analytics belongings in a deal reportedly price over $1 billion. IBM issued up to date historic figures for its high-margin software program section to raised mirror its financials with out these companies.

In early March, IBM stated it stopped doing enterprise in Russia after the nation invaded Ukraine.

“Russia is a really de minimis a part of IBM,” Jim Kavanaugh, the corporate’s finance chief, stated in an interview on Tuesday. The nation accounts for 0.5% of complete income and a couple of% of revenue, he stated. Administration hasn’t witnessed any results on enterprise in Western Europe on account of the departure, he stated.

IBM’s inventory has been outperforming the S&P 500 this 12 months, falling about 3% as of Monday’s shut, whereas the broader index is down 6%. Buyers have rotated into worth shares in 2022, given rising rates of interest and the battle in Europe.

“The inflationary impacts and the escalating value of expertise acquisition are actual,” Kavanaugh throughout the interview.

The gross margin of IBM’s consulting enterprise contracted to 24.3% from 27.8% within the year-ago quarter, and the companywide gross margin reached 51.7%, in contrast with 53.3% one 12 months in the past. Acquisitions reduce into margins along with increased prices to rent staff, Kavanaugh stated on the analyst name. IBM introduced the acquisitions of atmosphere information analytics software program maker Envizi and telecommunications consulting agency Sentaca within the first quarter.

Kavanaugh stated increased contract costs will bolster the pre-tax margin of its consulting enterprise in 2022, which must be up 2 share factors. Excessive progress in consulting is coming from engagements associated to choices from Adobe, Salesforce and public-cloud suppliers, Krishna stated.

Demand for expertise ought to persist even when the economic system goes into recession or if gross home product fails to develop, Krishna stated.

Correction: This story has been up to date to precisely mirror IBM’s 2022 forecast.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Bitcoin Cash

Bitcoin Cash  WhiteBIT Coin

WhiteBIT Coin  Cardano

Cardano  USDS

USDS  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Ethena USDe

Ethena USDe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  Canton

Canton  Monero

Monero  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Zcash

Zcash  Rain

Rain  sUSDS

sUSDS  Hedera

Hedera  Litecoin

Litecoin  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Dai

Dai  PayPal USD

PayPal USD  Avalanche

Avalanche  WETH

WETH  Shiba Inu

Shiba Inu  Sui

Sui  Toncoin

Toncoin  USDT0

USDT0  Cronos

Cronos  World Liberty Financial

World Liberty Financial  Tether Gold

Tether Gold  MemeCore

MemeCore  PAX Gold

PAX Gold  Polkadot

Polkadot  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  Aave

Aave  Pepe

Pepe  Bittensor

Bittensor  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Aster

Aster  Falcon USD

Falcon USD  Bitget Token

Bitget Token  OKB

OKB  Circle USYC

Circle USYC  Global Dollar

Global Dollar  syrupUSDC

syrupUSDC  HTX DAO

HTX DAO  Pi Network

Pi Network  Sky

Sky  Ripple USD

Ripple USD  Ethereum Classic

Ethereum Classic  NEAR Protocol

NEAR Protocol  Ondo

Ondo  BFUSD

BFUSD  Internet Computer

Internet Computer  Pump.fun

Pump.fun  Worldcoin

Worldcoin  Gate

Gate  POL (ex-MATIC)

POL (ex-MATIC)  Cosmos Hub

Cosmos Hub  KuCoin

KuCoin  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Quant

Quant  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Ethena

Ethena  Midnight

Midnight  Jito Staked SOL

Jito Staked SOL  NEXO

NEXO  USDtb

USDtb  Algorand

Algorand  Binance-Peg WETH

Binance-Peg WETH  Rocket Pool ETH

Rocket Pool ETH  Official Trump

Official Trump  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Render

Render  Wrapped BNB

Wrapped BNB  Function FBTC

Function FBTC

GIPHY App Key not set. Please check settings