S&P 500 futures had been little modified Wednesday as buyers digested disappointing Netflix earnings together with a number of different company reviews that helped pull the opposite main indexes in reverse instructions.

Dow Jones Industrial Common futures had been up 126 factors, or 0.3%. S&P 500 futures rose 0.4%, and Nasdaq 100 futures jumped 0.5%.

The strikes got here even after Netflix posted a 26% loss in its share value in premarket buying and selling after reporting a lack of 200,000 subscribers within the first quarter. The information led shares of streaming firms Disney, Roku, Warner Bros. Discovery and Paramount to fall, as buyers and will additional fear buyers about shopping for expertise shares forward of earnings. A slew of analysts additionally slashed their rankings on Netflix following its first-quarter outcomes.

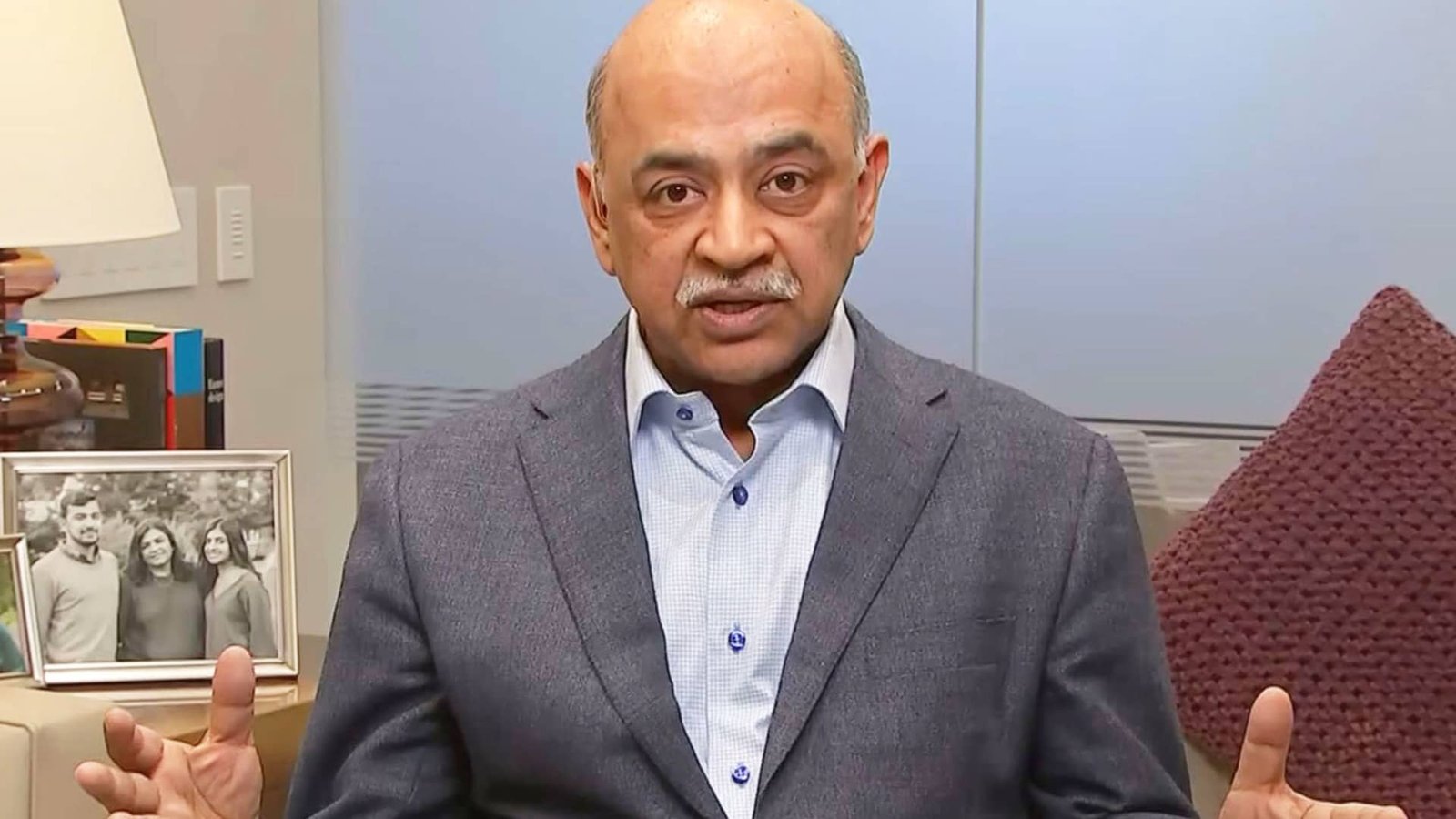

In the meantime, Procter & Gamble’s better-than-expected outcomes despatched the top off about 1%. Procter additionally hiked its full-year income steerage. Shares of IBM, one other Dow part, rose greater than 1% following a beat on earnings and income.

Tesla and United Airways are slated to report after the bell.

Past firm earnings, buyers had been additionally maintaining an in depth eye on the 10-year U.S. Treasury yield, which retreated Wednesday from a three-year excessive. On Tuesday the speed touched 2.94%, its highest stage since late 2018.

All the key averages noticed sturdy positive aspects on Tuesday, posting their greatest day since March 16. The Nasdaq Composite bounced again 2.15%, whereas the Dow Jones Industrial Common rose 499.51 factors, or 1.45% and the S&P 500 gained 1.61%.

Tuesday’s inventory market rally was broad-based with 10 out of 11 sectors ending the session within the constructive, led by client discretionary. A number of the greatest positive aspects got here from Microsoft and Alphabet, which rose 1.7% and 1.8%, respectively, whereas airline shares jumped after TSA lifted masks mandates on planes in response to a Florida courtroom ruling.

In the meantime, oil costs fell about 5% after the Worldwide Financial Fund minimize its financial progress forecasts and warned of dangers from larger inflation.

“I simply assume immediately we’re in a market the place various things are shining,” Ally Make investments’s Lindsey Bell informed CNBC’s “Closing Bell” on Tuesday. “We have a fantastic earnings season thus far and immediately the market is specializing in that. They’re specializing in the VIX that is coming down and naturally, oil costs — the autumn in oil costs helps the inflationary story.”

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Bitcoin Cash

Bitcoin Cash  WhiteBIT Coin

WhiteBIT Coin  Cardano

Cardano  USDS

USDS  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Ethena USDe

Ethena USDe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  Canton

Canton  Monero

Monero  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Zcash

Zcash  Rain

Rain  sUSDS

sUSDS  Hedera

Hedera  Litecoin

Litecoin  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Dai

Dai  PayPal USD

PayPal USD  Avalanche

Avalanche  WETH

WETH  Shiba Inu

Shiba Inu  Sui

Sui  Toncoin

Toncoin  USDT0

USDT0  Cronos

Cronos  World Liberty Financial

World Liberty Financial  Tether Gold

Tether Gold  MemeCore

MemeCore  PAX Gold

PAX Gold  Polkadot

Polkadot  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  Aave

Aave  Pepe

Pepe  Bittensor

Bittensor  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Aster

Aster  Falcon USD

Falcon USD  OKB

OKB  Bitget Token

Bitget Token  Circle USYC

Circle USYC  Global Dollar

Global Dollar  syrupUSDC

syrupUSDC  HTX DAO

HTX DAO  Pi Network

Pi Network  Sky

Sky  Ripple USD

Ripple USD  Ethereum Classic

Ethereum Classic  NEAR Protocol

NEAR Protocol  Ondo

Ondo  BFUSD

BFUSD  Internet Computer

Internet Computer  Pump.fun

Pump.fun  Worldcoin

Worldcoin  POL (ex-MATIC)

POL (ex-MATIC)  Gate

Gate  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Ethena

Ethena  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Midnight

Midnight  Jito Staked SOL

Jito Staked SOL  NEXO

NEXO  Algorand

Algorand  USDtb

USDtb  Binance-Peg WETH

Binance-Peg WETH  Rocket Pool ETH

Rocket Pool ETH  Official Trump

Official Trump  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Render

Render  Wrapped BNB

Wrapped BNB  Filecoin

Filecoin  Function FBTC

Function FBTC

GIPHY App Key not set. Please check settings