Bitcoin topped $22,000 because it continues a week-long rally forward of U.S. inflation information and a extremely anticipated Ethereum community improve.

The world’s largest cryptocurrency hit $22,341.50 at 9:45 p.m. ET Sunday earlier than dipping barely, in keeping with CoinDesk information. Bitcoin was buying and selling at $22,203 at round 4:03 a.m. ET on Monday.

After falling under $19,000 on Wednesday to its lowest degree since June, bitcoin has since rallied round 17%.

This additionally comes off the again of a profitable week final week for U.S. shares. Bitcoin has been carefully correlated to fairness markets, significantly the Nasdaq, and infrequently strikes larger when the tech-heavy index rises.

Crypto traders are looking forward to the August shopper value index report, scheduled to be launched Tuesday, to see the course inflation is headed which may give hints towards future coverage strikes by the U.S. Federal Reserve.

Crypto faces an uncommon double whammy this week: U.S. inflation information and [hopefully] the long-awaited and oft-delayed Ethereum Merge. Maintain your breath for a rollercoaster experience.

Antoni Trenchev

co-founder, Nexo

Shares have been underneath strain this 12 months because the Fed has hiked rates of interest to attempt to management rampant inflation.

Cryptocurrencies, that are additionally danger belongings, have been battered. Practically $2 trillion has been wiped off the complete crypto market since its all-time excessive in November. Bitcoin is down greater than 50% this 12 months.

That decline has additionally been pushed by crypto-specific points together with the collapse of key tasks and bankruptcies which have unfold throughout the business.

In the meantime, the Ethereum community will full a long-awaited improve referred to as the merge. It will remodel the Ethereum blockchain from a proof-of-work to proof-of-stake mannequin and considerably scale back the quantity of vitality required for the community to function.

Proponents say this might pave the way in which for a broader use of ether, the token that runs on Ethereum.

“Crypto faces an uncommon double whammy this week: U.S. inflation information and [hopefully] the long-awaited and oft-delayed Ethereum Merge. Maintain your breath for a rollercoaster experience,” Antoni Trenchev, co-founder of Nexo, stated in a be aware on Monday.

“In a time awash with narratives, there’s none greater than the Merge in crypto and it is one which the broader world ought to take discover of with Ethereum’s carbon footprint set to be slashed by 99%.”

Nevertheless, analysts cautioned that the merge won’t essentially pace up the Ethereum community, which is understood to be gradual, nor will it scale back the charges related to transactions.

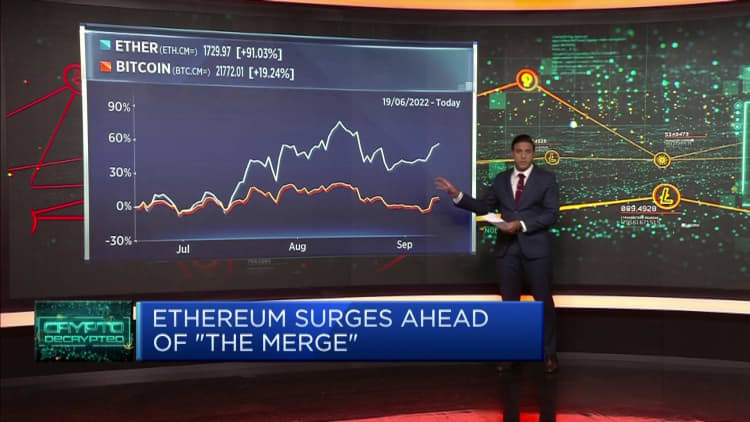

Nonetheless, pleasure has been rising for the merge. Since ether hit its low for the 12 months in mid-June, the value for the world’s second-largest cryptocurrency has far outpaced bitcoin’s. Ether is up greater than 90% since June. 19 whereas bitcoin has risen simply over 20%, begging the query of how a lot the merge has already been priced in.

The Federal Reserve can be extensively anticipated to extend rates of interest once more subsequent week when its Federal Open Market Committee (FOMC) meets, which is one other darkish cloud hanging over the crypto market.

“The Merge could set off a ‘promote the very fact’ scenario within the crypto market and we nonetheless should be cautious for subsequent week’s FOMC assembly. Bitcoin may proceed to rally but it surely might be fairly brief lived,” Yuya Hasegawa, crypto market analyst at Japanese alternate Bitbank, stated in a be aware Monday.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Bitcoin Cash

Bitcoin Cash  WhiteBIT Coin

WhiteBIT Coin  USDS

USDS  Cardano

Cardano  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Ethena USDe

Ethena USDe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Canton

Canton  Chainlink

Chainlink  Monero

Monero  USD1

USD1  Wrapped eETH

Wrapped eETH  Stellar

Stellar  Rain

Rain  sUSDS

sUSDS  Dai

Dai  Hedera

Hedera  PayPal USD

PayPal USD  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Zcash

Zcash  Litecoin

Litecoin  Avalanche

Avalanche  WETH

WETH  Shiba Inu

Shiba Inu  Sui

Sui  Toncoin

Toncoin  USDT0

USDT0  World Liberty Financial

World Liberty Financial  Cronos

Cronos  Tether Gold

Tether Gold  MemeCore

MemeCore  PAX Gold

PAX Gold  Uniswap

Uniswap  Polkadot

Polkadot  Ethena Staked USDe

Ethena Staked USDe  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Mantle

Mantle  Falcon USD

Falcon USD  Aave

Aave  Aster

Aster  Pepe

Pepe  Global Dollar

Global Dollar  Bittensor

Bittensor  OKB

OKB  Circle USYC

Circle USYC  Bitget Token

Bitget Token  syrupUSDC

syrupUSDC  Ripple USD

Ripple USD  HTX DAO

HTX DAO  Pi Network

Pi Network  Sky

Sky  BFUSD

BFUSD  Ethereum Classic

Ethereum Classic  NEAR Protocol

NEAR Protocol  Ondo

Ondo  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Gate

Gate  Internet Computer

Internet Computer  POL (ex-MATIC)

POL (ex-MATIC)  Pump.fun

Pump.fun  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Worldcoin

Worldcoin  Midnight

Midnight  Quant

Quant  Jito Staked SOL

Jito Staked SOL  USDtb

USDtb  NEXO

NEXO  Ethena

Ethena  Binance-Peg WETH

Binance-Peg WETH  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Rocket Pool ETH

Rocket Pool ETH  Official Trump

Official Trump  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Algorand

Algorand  USDD

USDD  Wrapped BNB

Wrapped BNB  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Function FBTC

Function FBTC

GIPHY App Key not set. Please check settings