An individual outlets in a grocery store as inflation affected shopper costs in New York Metropolis, June 10, 2022.

Andrew Kelly | Reuters

For the higher a part of a 12 months, the inflation narrative amongst many economists and policymakers was that it was basically a meals and gas downside. As soon as provide chains eased and fuel costs abated, the pondering went, that might assist decrease meals prices and in flip ease value pressures throughout the financial system.

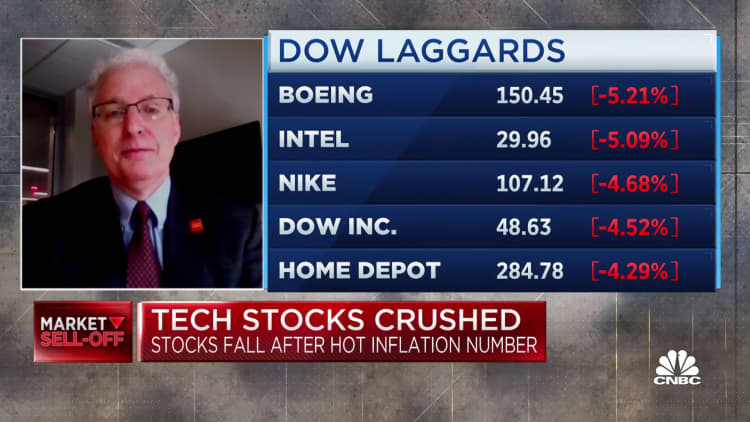

August’s shopper value index numbers, nevertheless, examined that narrative severely, with broadening will increase indicating now that inflation may very well be extra persistent and entrenched than beforehand thought.

CPI excluding meals and power costs — so-called core inflation — rose 0.6% for the month, double the Dow Jones estimate, bringing year-over-year cost-of-living will increase up 6.3%. Together with meals and power, the index rose 0.1% month-to-month and a strong 8.3% on a 12-month foundation.

Not less than as essential, the supply of the rise wasn’t gasoline, which tumbled 10.6% for the month. Whereas {the summertime} decline in power costs has helped mood headline inflation numbers, it hasn’t been in a position to squelch fears that inflation will stay an issue for a while.

The broadening of inflation

Fairly than gas, it was meals, shelter and medical companies that drove prices increased in August, slapping a pricey tax on these least in a position to afford it and elevating essential questions on the place inflation goes from right here.

“The core inflation numbers had been scorching throughout the board. The breadth of the sturdy value will increase, from new autos to medical care companies to lease progress, every thing was up strongly,” mentioned Mark Zandi, chief economist at Moody’s Analytics. “That was probably the most disconcerting facet of the report.”

Certainly, new car costs and medical care companies each elevated 0.8% for the month. Shelter prices, which embody rents and numerous different housing-related bills, make up practically a 3rd of the CPI weighting and climbed 0.7% for the month.

Meals prices even have been nettlesome.

The meals at residence index, proxy for grocery costs, has elevated 13.5% over the previous 12 months, the biggest such rise since March 1979. Costs continued their meteoric climb for objects similar to eggs and bread, additional straining family budgets.

For medical care companies, the month-to-month enhance of 0.8% is the quickest month-to-month acquire since October 2019. Veterinary prices rose 0.9% on the month and had been up 10% over the previous 12 months.

“Even issues like attire costs, which frequently decline, had been up a bit bit [0.2%]. My view is that with these decrease oil costs, they stick and assuming they do not return up, that can see a broad moderation of inflation,” Zandi mentioned. “I’ve not modified my forecast for inflation to get again to [the Federal Reserve’s 2% target] by early 2024, however I might say I maintain that forecast with much less conviction.”

On the optimistic aspect, costs got here down once more for issues similar to airline tickets, espresso and fruit. A survey launched earlier this week by the New York Fed confirmed shoppers are rising much less fearful about inflation, although they nonetheless count on the speed to be 5.7% a 12 months from now. There are also indicators that offer chain pressures are easing, which needs to be at the least disinflationary.

Increased oil doable

However about three-quarters of the CPI remained above 4% in year-over-year inflation, reflecting a longer-term development that has refuted the thought of “transitory” inflation that the White Home and the Fed had been pushing.

And power costs staying low isn’t any given.

The U.S. and different G-7 nations say they intend to slap value controls on Russian oil exports beginning Dec. 5, presumably inviting retaliation that might see late-year value will increase.

“Ought to Moscow reduce off all pure fuel and oil exports to the European Union, United States and United Kingdom, then it’s extremely possible that oil costs will retest the highs set in June and trigger the common value of normal fuel to maneuver nicely again above the present $3.70 per gallon,” mentioned Joseph Brusuelas, chief economist at RSM.

Brusuelas added that even with housing in a stoop and doable recession, he thinks value drops there most likely will not feed by way of, as housing has ” 12 months or so to go earlier than the info in that crucial ecosystem improves.”

With a lot inflation nonetheless within the pipeline, the large financial query is how far the Fed will go together with rate of interest will increase. Markets are betting the central financial institution raises benchmark charges by at the least 0.75 proportion level subsequent week, which might take the fed funds price to its highest degree since early 2007.

“Two p.c represents value stability. It is their objective. However how do they get there with out breaking one thing,” mentioned Quincy Krosby, chief fairness strategist at LPL Monetary. “The Fed is not completed. The trail to 2% goes to be tough. Total, we should always begin to see inflation proceed to inch decrease. However at what level do they cease?”

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc  Dogecoin

Dogecoin  WhiteBIT Coin

WhiteBIT Coin  USDS

USDS  Bitcoin Cash

Bitcoin Cash  Cardano

Cardano  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Ethena USDe

Ethena USDe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Canton

Canton  Monero

Monero  Chainlink

Chainlink  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Rain

Rain  sUSDS

sUSDS  Dai

Dai  PayPal USD

PayPal USD  Hedera

Hedera  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Zcash

Zcash  Litecoin

Litecoin  Avalanche

Avalanche  WETH

WETH  Shiba Inu

Shiba Inu  Sui

Sui  Toncoin

Toncoin  USDT0

USDT0  World Liberty Financial

World Liberty Financial  Cronos

Cronos  Tether Gold

Tether Gold  MemeCore

MemeCore  PAX Gold

PAX Gold  Uniswap

Uniswap  Polkadot

Polkadot  Ethena Staked USDe

Ethena Staked USDe  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Mantle

Mantle  Falcon USD

Falcon USD  Aave

Aave  Aster

Aster  Pepe

Pepe  Global Dollar

Global Dollar  Bittensor

Bittensor  Circle USYC

Circle USYC  Ripple USD

Ripple USD  OKB

OKB  syrupUSDC

syrupUSDC  Bitget Token

Bitget Token  Sky

Sky  HTX DAO

HTX DAO  Pi Network

Pi Network  BFUSD

BFUSD  Ethereum Classic

Ethereum Classic  NEAR Protocol

NEAR Protocol  Ondo

Ondo  POL (ex-MATIC)

POL (ex-MATIC)  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Internet Computer

Internet Computer  Gate

Gate  KuCoin

KuCoin  Worldcoin

Worldcoin  Pump.fun

Pump.fun  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Cosmos Hub

Cosmos Hub  Midnight

Midnight  Quant

Quant  USDtb

USDtb  Jito Staked SOL

Jito Staked SOL  NEXO

NEXO  pippin

pippin  Ethena

Ethena  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Binance-Peg WETH

Binance-Peg WETH  Official Trump

Official Trump  Rocket Pool ETH

Rocket Pool ETH  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  OUSG

OUSG  Algorand

Algorand  Wrapped BNB

Wrapped BNB  USDD

USDD  Function FBTC

Function FBTC

GIPHY App Key not set. Please check settings