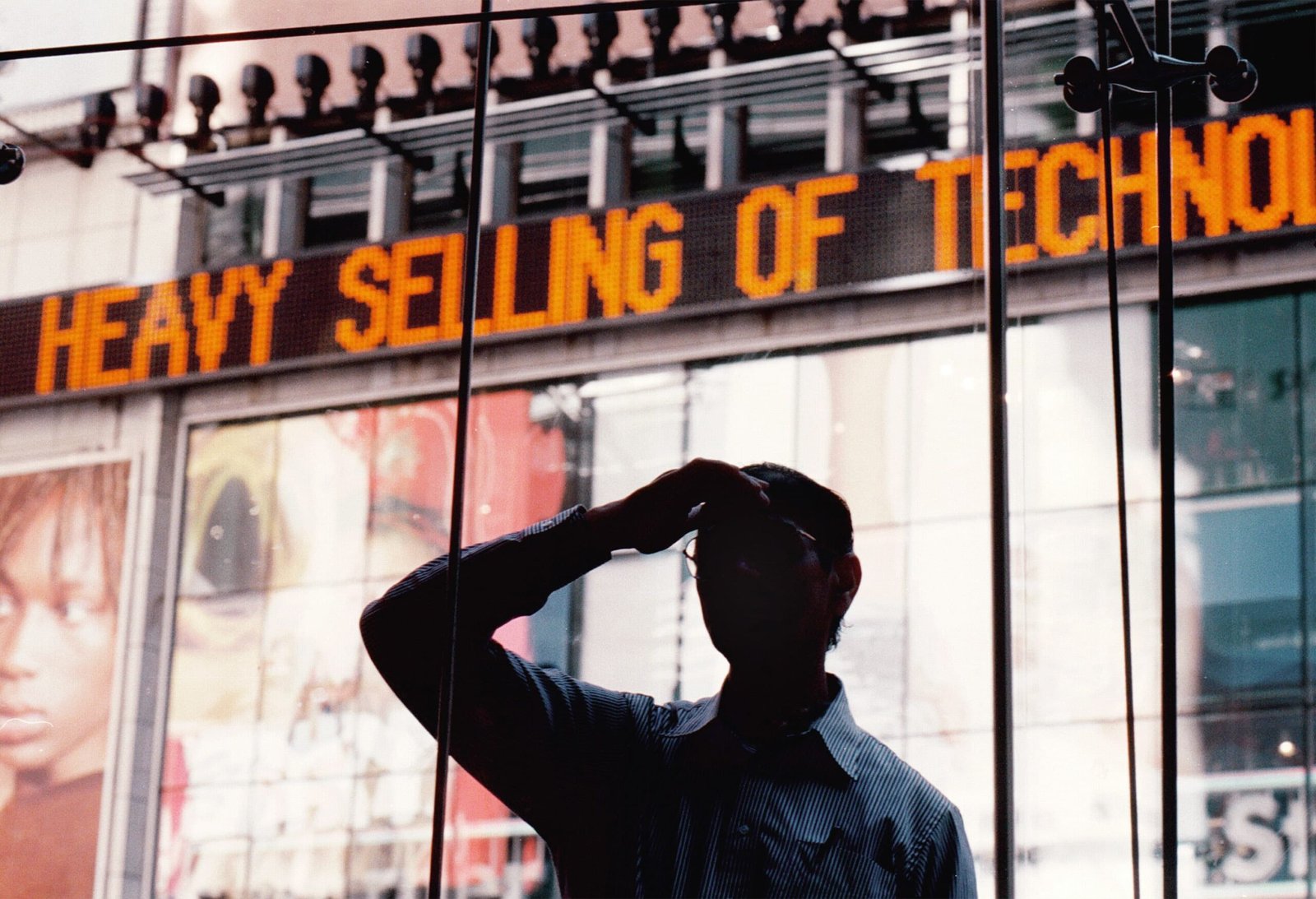

Brendan McDermid | Reuters

Virtually as predictable as the massive jolly elf himself, the Santa Claus rally within the inventory market comes round in late December.

That’s, the markets are likely to rise over a stretch of time proper earlier than and after the calendar flips to the brand new 12 months. Particularly, the rally entails the final 5 buying and selling classes of the 12 months and the primary two of the brand new 12 months, in accordance with the Inventory Dealer’s Almanac, which coined the time period many years in the past.

And to date, this 12 months is not any totally different.

Extra from Private Finance:

Find out how to get again on monitor after blowing your finances

There’s nonetheless time to slash your 2021 tax invoice

Proposed retirement system adjustments are nonetheless in play

“Why are these seven days so sturdy?” mentioned LPL Monetary Chief Market Strategist Ryan Detrick in a analysis be aware. “Whether or not optimism over a coming new 12 months, vacation spending, merchants on trip, establishments squaring up their books — or the vacation spirit — the underside line is that bulls are likely to imagine in Santa.”

This 12 months, the seven-day stretch started Monday, with the rally off to a very good begin.

The S&P 500 Index gained almost 1.4% to shut the day at a recent excessive of 4,791.19 — it is 69th report shut of the 12 months. The Dow Jones Industrial Common rose about 1% to 36,302.38, and the Nasdaq Composite index closed at 15,871.26, up 1.4% for the day.

Whereas there is no assure that the market will find yourself posting a achieve through the full rally interval, the S&P 500 has been constructive almost 79% of the time throughout these days since 1928, with a median achieve of 1.7%, a Financial institution of America evaluation exhibits.

Within the final 10 years, there’s been a decline simply twice within the S&P 500 through the Santa Claus rally interval, in accordance with CNBC’s Robert Hum. Within the eight years that the index rose, the achieve averaged 1%.

Already this 12 months, the foremost indexes have posted outsized returns. The S&P 500 is up 29.5%; the Dow, 20.5%; and the Nasdaq, 24.5%. Over time, the common annual return for the inventory market is about 10%.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Bitcoin Cash

Bitcoin Cash  WhiteBIT Coin

WhiteBIT Coin  Cardano

Cardano  USDS

USDS  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Ethena USDe

Ethena USDe  Monero

Monero  Canton

Canton  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Rain

Rain  sUSDS

sUSDS  Hedera

Hedera  Zcash

Zcash  Litecoin

Litecoin  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Dai

Dai  PayPal USD

PayPal USD  Avalanche

Avalanche  WETH

WETH  Shiba Inu

Shiba Inu  Sui

Sui  World Liberty Financial

World Liberty Financial  USDT0

USDT0  Toncoin

Toncoin  Cronos

Cronos  Tether Gold

Tether Gold  PAX Gold

PAX Gold  MemeCore

MemeCore  Uniswap

Uniswap  Polkadot

Polkadot  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Aave

Aave  Aster

Aster  Pepe

Pepe  Bittensor

Bittensor  Falcon USD

Falcon USD  OKB

OKB  Bitget Token

Bitget Token  Global Dollar

Global Dollar  Circle USYC

Circle USYC  syrupUSDC

syrupUSDC  Pi Network

Pi Network  Ripple USD

Ripple USD  HTX DAO

HTX DAO  Sky

Sky  Ethereum Classic

Ethereum Classic  NEAR Protocol

NEAR Protocol  BFUSD

BFUSD  Ondo

Ondo  Pump.fun

Pump.fun  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Internet Computer

Internet Computer  POL (ex-MATIC)

POL (ex-MATIC)  Cosmos Hub

Cosmos Hub  Gate

Gate  KuCoin

KuCoin  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Worldcoin

Worldcoin  Midnight

Midnight  NEXO

NEXO  Jito Staked SOL

Jito Staked SOL  Ethena

Ethena  USDtb

USDtb  Binance-Peg WETH

Binance-Peg WETH  Official Trump

Official Trump  Rocket Pool ETH

Rocket Pool ETH  Algorand

Algorand  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Render

Render  Wrapped BNB

Wrapped BNB  USDD

USDD  Function FBTC

Function FBTC  Filecoin

Filecoin

GIPHY App Key not set. Please check settings