President Joe Biden known as on Congress Wednesday to briefly droop the federal fuel tax, as he tries to quell the fast surge in costs on the pump. Whereas consultants say a suspension might present some quick reduction, it might additionally preserve demand elevated, thereby exacerbating tight provide.

Customers are getting hit with greater costs in all places, which has turn out to be a headache for the administration forward of November’s midterm elections.

However the rise in gasoline costs is maybe probably the most noticeable pressure on client pocketbooks — indicators at nook fuel bars throughout the nation declare the unhealthy information, the present worth per gallon. The nationwide common topped $5 per gallon for the primary time ever earlier this month.

It has turn out to be an Achilles’ heel for the administration, famous OPIS International’s Tom Kloza, “regardless that it has nothing to do with any insurance policies [Biden’s] had since he got here into energy.”

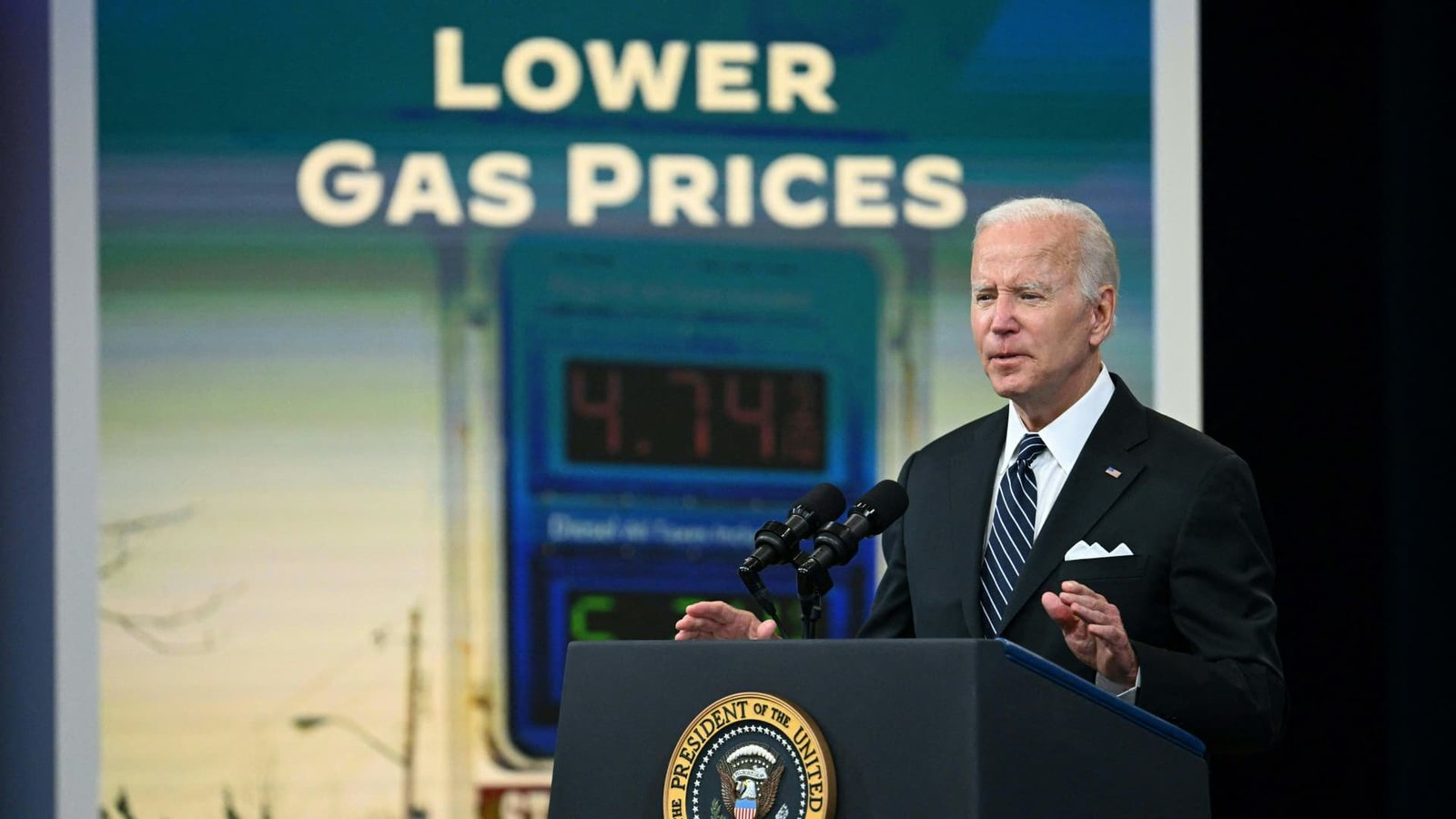

US President Joe Biden delivers remarks on efforts to decrease excessive fuel costs within the South Courtroom Auditorium at Eisenhower Govt Workplace Constructing June 22, 2022 in Washington, DC.

Jim Watson | AFP | Getty Photographs

Biden’s plan asks Congress to droop the federal tax on gasoline and diesel gasoline for 3 months, which coincides with the summer time driving season. The federal tax is eighteen cents per gallon of standard gasoline and 24 cents per gallon for diesel.

The president can also be asking states to droop their fuel taxes, or discover different methods to offer reduction for customers.

A suspension would “give Individuals a little bit further respiratory room as they cope with the results of [Russian President Vladimir] Putin’s conflict in Ukraine,” the White Home mentioned in an announcement.

“If this invoice is signed and enacted — turns into efficient — it should assist motorists,” mentioned Patrick De Haan, head of petroleum evaluation at GasBuddy. However he added that the extent to which any reduction is felt will depend upon wholesale costs remaining steady. The wording and timing of any potential laws will even have an effect.

De Haan pointed to New York for instance. The state suspended its fuel tax, however at a time when wholesale gasoline costs have been rising. Finally, customers did not see a lot of an affect on the pump as a result of the tax transfer was offset by greater wholesale costs.

Nonetheless, he mentioned that if this federal measure have been applied right now it will “significantly improve the draw back,” since gasoline futures have pulled again just lately, after rising above $4.

It is unclear whether or not Biden has congressional help for the laws. The proposal comes at a key time within the runup to the November midterm elections.

The president has repeatedly taken purpose at oil and fuel firms for what he claims are insurance policies that prioritize income on the expense of customers. Final week, he known as on refiners to ramp up output. The trade, for its half, says the White Home has unfriendly insurance policies, and so they cannot enhance output even when they wished to, citing points like labor shortages.

The administration doesn’t management fuel costs. Greater than half of the associated fee per gallon of gasoline is predicated on the underlying worth of oil, which is ready on a world foundation and has spiked above $100 per barrel.

Jason Furman, professor of financial coverage at Harvard and former chair of the Council of Financial Advisers underneath President Barack Obama, mentioned a suspension would have little affect on customers whereas resulting in billions of {dollars} for oil firms.

“When refineries are already pressured to capability the extra demand that the fuel tax vacation will unleash will present itself virtually fully within the type of greater costs for producers as an alternative of financial savings for customers,” he mentioned, earlier than including: “I do not assume any skilled thinks this can be a remotely good thought.”

Goldman Sachs’ world head of commodities analysis, Jeff Currie, echoed this level, saying a fuel tax vacation will finally result in greater demand from customers. An often-cited phenomenon for commodity markets is that the remedy for top costs is excessive costs. Reducing costs is a short lived measure that will not deal with elementary market imbalances.

The nationwide common for a gallon of gasoline surged above $5 for the primary time ever earlier this month. Costs have since retreated barely, with the per-gallon nationwide common at $4.955 on Wednesday. That is up 36 cents within the final month and $1.88 greater than final yr.

The federal fuel tax has been 18.4 cents per gallon since 1993.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc  Dogecoin

Dogecoin  WhiteBIT Coin

WhiteBIT Coin  Cardano

Cardano  USDS

USDS  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  Ethena USDe

Ethena USDe  Canton

Canton  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Rain

Rain  sUSDS

sUSDS  Hedera

Hedera  Litecoin

Litecoin  Dai

Dai  Coinbase Wrapped BTC

Coinbase Wrapped BTC  PayPal USD

PayPal USD  Avalanche

Avalanche  Zcash

Zcash  WETH

WETH  Sui

Sui  Shiba Inu

Shiba Inu  Toncoin

Toncoin  USDT0

USDT0  Cronos

Cronos  World Liberty Financial

World Liberty Financial  Tether Gold

Tether Gold  Polkadot

Polkadot  PAX Gold

PAX Gold  Uniswap

Uniswap  MemeCore

MemeCore  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Circle USYC

Circle USYC  Bittensor

Bittensor  Global Dollar

Global Dollar  Aster

Aster  Falcon USD

Falcon USD  Aave

Aave  NEAR Protocol

NEAR Protocol  Sky

Sky  Pi Network

Pi Network  OKB

OKB  syrupUSDC

syrupUSDC  Ripple USD

Ripple USD  Bitget Token

Bitget Token  Pepe

Pepe  HTX DAO

HTX DAO  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  BFUSD

BFUSD  Ondo

Ondo  Pump.fun

Pump.fun  Worldcoin

Worldcoin  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Gate

Gate  POL (ex-MATIC)

POL (ex-MATIC)  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  KuCoin

KuCoin  Midnight

Midnight  Ethena

Ethena  Quant

Quant  Ondo US Dollar Yield

Ondo US Dollar Yield  Jito Staked SOL

Jito Staked SOL  Cosmos Hub

Cosmos Hub  NEXO

NEXO  USDtb

USDtb  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Binance-Peg WETH

Binance-Peg WETH  Rocket Pool ETH

Rocket Pool ETH  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Official Trump

Official Trump  Algorand

Algorand  Wrapped BNB

Wrapped BNB  Aptos

Aptos  Function FBTC

Function FBTC

GIPHY App Key not set. Please check settings