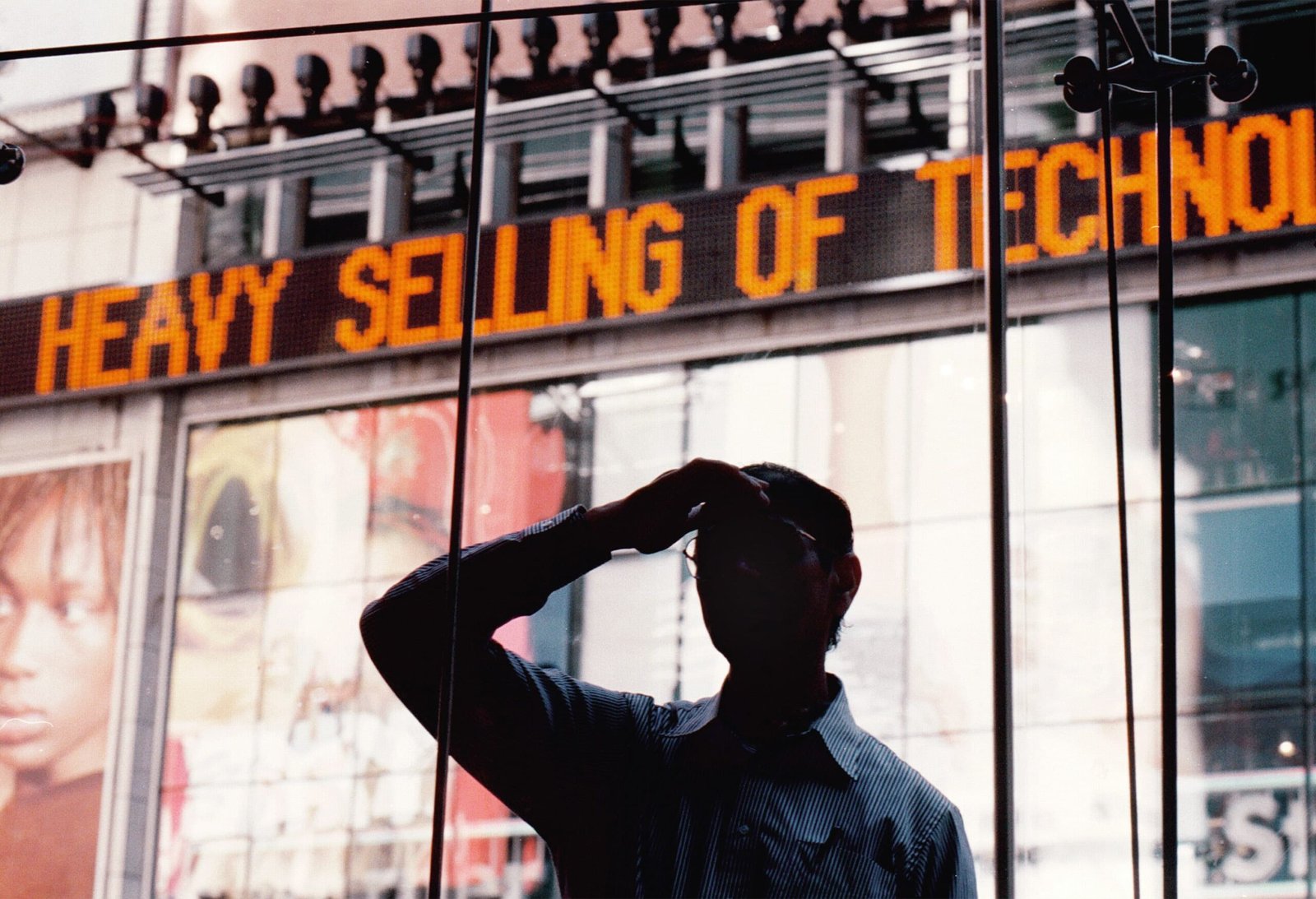

Chris Hondros | Newsmakers | Getty Photographs

For the primary time in 5 years, tech buyers aren’t the lifetime of the Wall Avenue get together.

As 2021 winds down, the tech-heavy Nasdaq Composite is up 23% for the yr, trailing the S&P 500, which has climbed 28%, via Monday. The final two occasions the S&P 500 topped the Nasdaq occurred in 2016 and 2011.

Tech shares have 4 days left to make up that distinction, however the final week of the yr does not are inclined to carry a lot information that may spur an outsized rally. Indexes have been up throughout the board on Monday, with the S&P 500 climbing to a file.

Nasdaq vs. S&P 500 in 2021

CNBC

The Nasdaq began 2021 robust, choosing up the place it left off in 2020, virtually doubling up the S&P 500’s features by mid-February. Then buying and selling tailed off with the arrival of the primary Covid-19 vaccines, which raised hopes amongst buyers that the U.S. was on the verge of getting via the pandemic, probably lessening demand for distant work expertise, dwelling exercise methods, meals supply apps and tech-based lounge leisure.

Subsequent, inflation reared its head, topping 4% in April, then as excessive as 6.8% in November. The Federal Reserve initially anticipated rising costs to be transitory, however they persevered, spurring the central financial institution to take a extra engaged stance, citing expectations for charge hikes in 2022.

That is created a double whammy for high-multiple tech shares. Buyers are frightened concerning the demand aspect of a few of their companies, they usually’re additionally rotating into sectors of the market that have a tendency to carry up higher in a rising charge setting.

“All of the stay-at-home, play-at-home, work-from-home shares have been DOA in 2021, just like the pandemic did not exist anymore,” stated Jake Dollarhide, CEO of Longbow Asset Administration in Tulsa, Okla. “The final 5 years, each time it appeared like there can be a rotation out of tech, everyone purchased the dip — 2021 will go down because the yr that buyers didn’t purchase the dip in tech.”

Throughout the S&P 500, the top-performing subgroup of the yr was power, reflecting hovering gasoline costs. Subsequent got here actual property, which delivers excessive dividends and has benefited from surging demand for warehouse area and residential properties.

Tech is not too far behind, largely as a result of mega-cap firms Apple and Microsoft have held up properly and make up a lot of the tech subgroup, and the general S&P 500. Alphabet and Meta Platforms (previously Fb) are a part of the communication providers sub-index and Amazon is within the shopper discretionary group. Each have barely underperformed the broader index.

The principle downside for the Nasdaq has been the plunging worth of firms that picked up large market caps in 2020, solely to see buyers flip towards them this yr.

Zoom inventory has dropped 45% this yr, after final yr’s 326% improve in income led to a quintupling in its inventory value. Peloton, in the meantime, has plummeted 76% after income progress peaked at 232% in mid-2020, pushing the refill over 430% for the yr.

Twilio, Spotify and Block (previously Sq.) have every fallen greater than 20% this yr and PayPal is down 18%. The WisdomTree Cloud Computing ETF, a basket of publicly traded cloud software program firms, is about flat for the yr after greater than doubling in 2020.

“I identified to purchasers, if you happen to’re heavy tech, you are prone to underperform the general market,” stated Dollarhide. “However take note how a lot you’ve got overperformed the market the final three to 4 years,”

In 2020, the Nasdaq climbed 44%, whereas the S&P 500 rose simply 16%. From the tip of 2016 to the shut of 2020, the Nasdaq received yearly, rising a complete of 139% in comparison with the S&P 500’s 68% improve.

Nasdaq vs. S&P 500 2017-2020

CNBC

Dollarhide stated he is used the latest pullback to purchase shares of some firms that he sees as properly positioned for the longer term even when they’ve fallen out of favor of late. DocuSign, for instance, is down 30% this yr after greater than tripling in 2020. Dollarhide stated his agency, via its relationship with Charles Schwab, is consistently utilizing DocuSign, as a result of Schwab “eradicated faxes, paper varieties, and it is the one method you may open a brand new account nowadays.”

“I am utilizing DocuSign 5, six, seven occasions a day, the place as I used to be doing faxes or mailings 5, six, seven occasions a day,” he stated.

One other buy he made was Zillow, which has plunged over 50% this yr, largely due to the corporate’s failed effort to crack the home-flipping market. The corporate exited the enterprise in November after racking up a lack of over $328 million within the newest quarter.

“Zillow is only a traditional misstep,” Dollarhide stated. “Stepping into and flipping homes — that is a horrible concept. We purchased on that dip. It is an overreaction to the draw back. They misplaced their method, frankly.” For buyers like Dollarhide, DocuSign, Zillow and even Zoom make for particular person shopping for alternatives.

To make certain, the efficiency distinction between the 2 indexes is not as notable because it was, with the Nasdaq and S&P 500 beginning to look extra alike.

The seven firms with the heftiest weightings within the S&P 500 — Apple, Microsoft, Alphabet, Amazon, Tesla, Meta and Nvidia — now make up about 27% of the index. They’re additionally the bulkiest members of the Nasdaq, which is the primary cause why the 2 indexes’ progress this yr are separated by just a few proportion factors.

“The market is changing into more and more FAANG,” stated Tom Lee, managing accomplice at Fundstrat International Advisors, referring to Fb, Apple, Amazon, Netflix and Google.

Lee, talking on CNBC’s “Halftime Report” on Monday, stated he views FAANG as extra than simply these firms, and contains different tech leaders with giant market share and pricing energy. Whereas he is involved concerning the impression of inflation and charges on the general market, Lee stated FAANG shares are his second favourite decide, behind power, heading into 2022.

“If there’s panic round inflation and Fed tightening, the remainder of the market takes it on the chin fairly exhausting,” Lee stated. “I believe FAANG is fairly strong within the first half and all the pieces else appears actually shaky.”

WATCH: This is why Fundstrat’s Tom Lee sees a pullback coming in 2022

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc  Dogecoin

Dogecoin  Bitcoin Cash

Bitcoin Cash  WhiteBIT Coin

WhiteBIT Coin  USDS

USDS  Cardano

Cardano  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Ethena USDe

Ethena USDe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Canton

Canton  Chainlink

Chainlink  Monero

Monero  USD1

USD1  Wrapped eETH

Wrapped eETH  Stellar

Stellar  Rain

Rain  sUSDS

sUSDS  Dai

Dai  Hedera

Hedera  PayPal USD

PayPal USD  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Litecoin

Litecoin  Zcash

Zcash  Avalanche

Avalanche  WETH

WETH  Shiba Inu

Shiba Inu  Sui

Sui  Toncoin

Toncoin  USDT0

USDT0  World Liberty Financial

World Liberty Financial  Cronos

Cronos  Tether Gold

Tether Gold  MemeCore

MemeCore  PAX Gold

PAX Gold  Uniswap

Uniswap  Polkadot

Polkadot  Ethena Staked USDe

Ethena Staked USDe  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Mantle

Mantle  Falcon USD

Falcon USD  Aave

Aave  Aster

Aster  Pepe

Pepe  Global Dollar

Global Dollar  Bittensor

Bittensor  Circle USYC

Circle USYC  OKB

OKB  Ripple USD

Ripple USD  syrupUSDC

syrupUSDC  Bitget Token

Bitget Token  HTX DAO

HTX DAO  Pi Network

Pi Network  Sky

Sky  BFUSD

BFUSD  NEAR Protocol

NEAR Protocol  Ethereum Classic

Ethereum Classic  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Ondo

Ondo  Gate

Gate  Internet Computer

Internet Computer  Pump.fun

Pump.fun  POL (ex-MATIC)

POL (ex-MATIC)  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Worldcoin

Worldcoin  Midnight

Midnight  Jito Staked SOL

Jito Staked SOL  NEXO

NEXO  USDtb

USDtb  Ethena

Ethena  Binance-Peg WETH

Binance-Peg WETH  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Rocket Pool ETH

Rocket Pool ETH  Official Trump

Official Trump  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Algorand

Algorand  USDD

USDD  Wrapped BNB

Wrapped BNB  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Function FBTC

Function FBTC  Render

Render

GIPHY App Key not set. Please check settings