A buyer’s groceries are rung up at a retailer in San Francisco, California, U.S., on Thursday, Nov. 11, 2021.

David Paul Morris | Bloomberg | Getty Photographs

Essential provide chains are choked off. Demand soars. Costs surge and everybody begins freaking out about inflation and surprise how lengthy it is going to final.

Is it 1945? 1916? 1974?

The reply, after all, is all the above, and you’ll throw 2021 in there as properly.

Inflation isn’t one thing new for the U.S. because the nation has weathered seven such episodes of lasting value surges since World Warfare II together with the present run, which is the strongest in 30 years. Getting out of the pandemic shock has been a troublesome train for the world’s largest financial system, and inflation has been a painful aspect impact.

However looking for a historic parallel – and, thus, maybe a approach out – is not simple. Just about each cycle bears at the least some similarities to others, however every is exclusive in its personal approach.

The most typical comparability to lately is the stagflation – low progress, excessive costs – surroundings of the Nineteen Seventies and early ’80s. And whereas there’s most likely at the least some validity to that, the truth is extra difficult.

“When it comes to how widespread inflation is, it is just about touching all the things. It is widespread, or greater than what we noticed within the Nineteen Seventies,” mentioned Peter Boockvar, chief funding officer at Bleakley Advisory Group. “The query is, how lengthy it stays elevated and when it backs off and at what price does it settle out?”

Most U.S. policymakers reject the Nineteen Seventies connection.

Leaders comparable to Federal Reserve Chairman Jerome Powell, Treasury Secretary Janet Yellen and Biden administration officers view inflation as non permanent and nearly wholly pushed by elements distinctive to the pandemic. As soon as these elements subside, they see inflation drifting decrease, ultimately getting across the 2% degree the Fed considers emblematic of a wholesome and rising financial system.

Some White Home economists have asserted that the present stretch appears to be like not just like the stagflation period, however extra just like the instant post-World Warfare II local weather, when value controls, provide issues and extraordinary demand fueled double-digit inflation features that did not subside till the late Nineteen Forties.

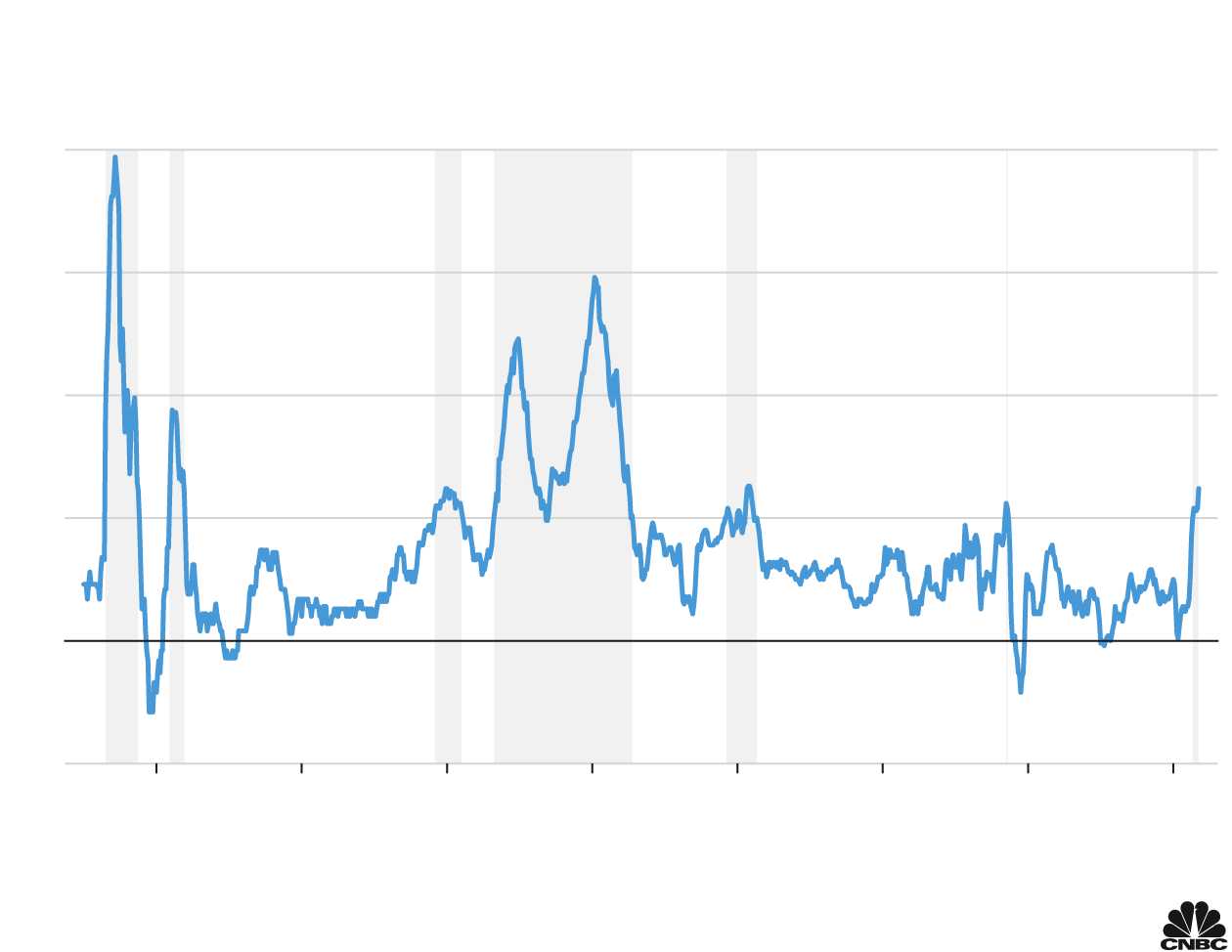

Episodes of U.S. inflation

Shopper value index, p.c change from a yr in the past

Word: Intervals of heightened inflation are shaded.

Supply: Bureau of Labor Statistics (CPI), White Home (inflationary durations by way of ‘08). Knowledge is

seasonally adjusted and as of Oct. ’21.

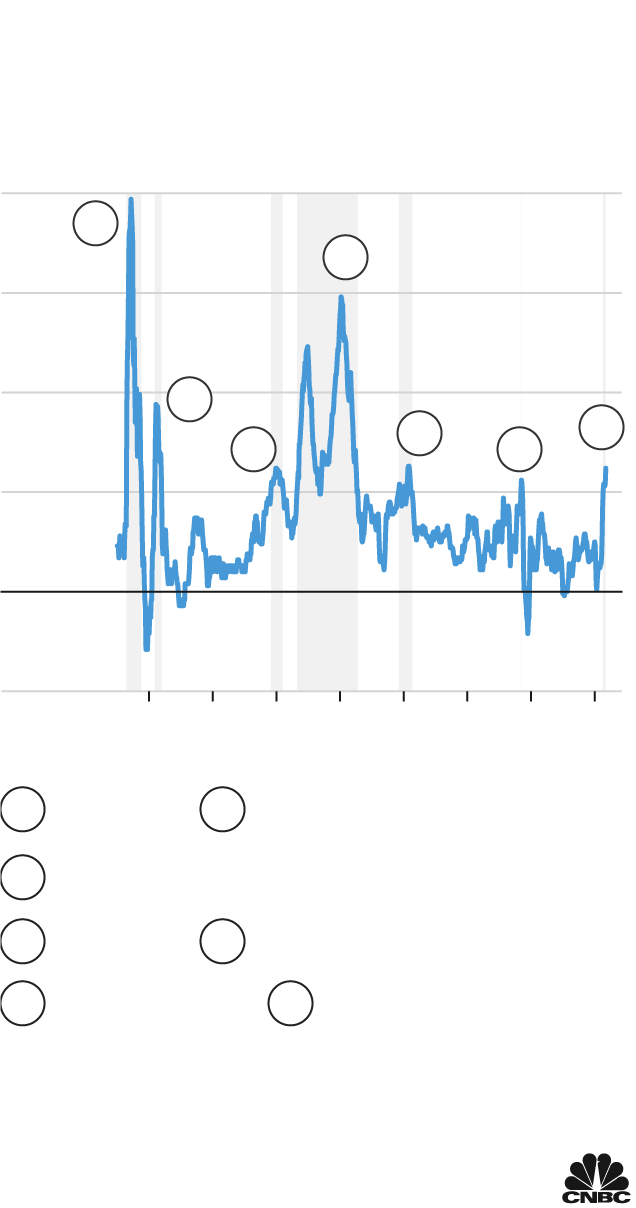

Episodes of U.S. inflation

Shopper value index, p.c change from

a yr in the past

Late 1960’s financial enlargement

Word: Intervals of heightened inflation are shaded.

Supply: Bureau of Labor Statistics (CPI), White

Home (inflationary durations by way of ‘08).

Knowledge is seasonally adjusted and as of Oct. ’21.

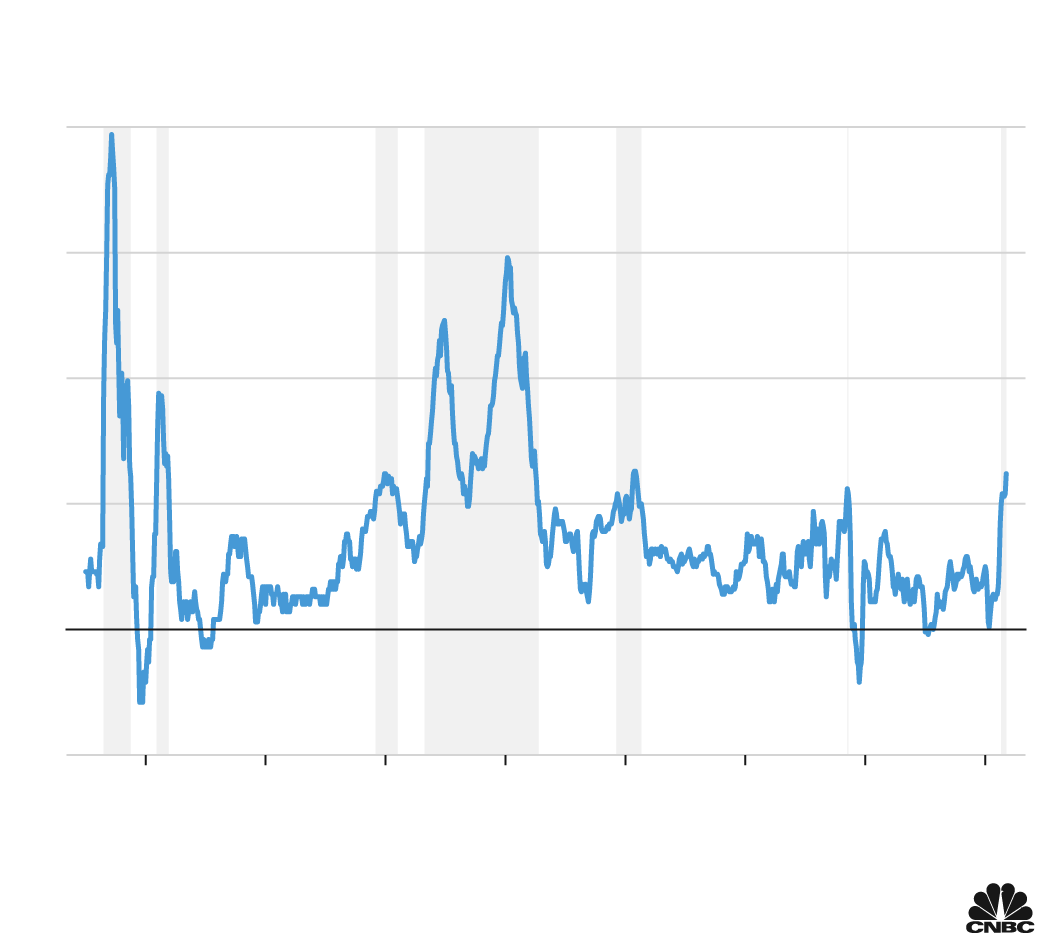

Episodes of U.S. inflation

Shopper value index, p.c change from a yr in the past

Word: Intervals of heightened inflation are shaded.

Supply: Bureau of Labor Statistics (CPI), White Home (inflationary durations by way of

‘08). Knowledge is seasonally adjusted and as of Oct. ’21.

“Immediately’s scarcity of sturdy items is comparable — a nationwide disaster necessitated disrupting regular manufacturing processes,” a crew of White Home economists wrote in a July 2021 paper. “As a substitute of redirecting sources to assist a warfare effort, nevertheless, manufacturing capabilities have been briefly shut down or decreased to keep away from COVID contagion.”

As soon as the provision chain disruptions are remedied – and there are indicators that at the least the main ports have gotten much less crowded in latest days – “inflation may rapidly decline as soon as provide chains are totally on-line and pent-up demand ranges off,” the paper acknowledged.

Transitory, everlasting or ‘in between’

The concept inflation is “transitory” – a well-worn time period that’s transitioning out of vogue – is central to the insistence from fiscal and financial authorities that excessively simple coverage is to not blame for the inflation surge.

Nonetheless, simple coverage has been on the core of many earlier cycles, and making an attempt in charge all the things on the pandemic hasn’t gone over particularly properly with shoppers, whose confidence is working at decade lows, and on Wall Avenue, the place buyers are getting antsy over how lengthy inflation will final.

Whether or not inflation is non permanent, the truth is, might be the most important debate taking place in investing circles lately.

A buyer pumps fuel into her car at a fuel station on November 22, 2021 in Miami, Florida.

Joe Raedle | Getty Photographs

“The talk is all the time couched in black and white. The truth is, it is most likely in between there,” mentioned Jim Paulsen, chief funding strategist on the Leuthold Group.

The truth is, Paulsen has studied inflation over the previous century or so and located that whereas there might been many durations the place it has change into problematic, there are solely two the place it proved lasting: after World Warfare I and within the aforementioned Nineteen Seventies-early ’80s.

He is largely within the camp that this run, too, will go because it has been fueled largely by provide chain issues that finally will resolve.

Nonetheless, he is cautious of being improper.

“It is not as non permanent as we first thought, however I nonetheless suppose that is the most effective odds” that it’s going to go within the coming months, Paulsen mentioned. “However I might additionally say that it’s undoubtedly the most important danger that it is not. If it is not, then it is a disastrous end result not just for shares but additionally for the financial system if it is actually runaway.”

The inflation hazard comes as a result of this cycle is in contrast to some other in a single necessary approach: Policymakers have by no means thrown something near this sum of money on the financial system.

What if someday subsequent yr we not solely declare pseudo-victory over Covid, however we declare it over inflation, too?

Jim Paulsen

chief funding strategist, the Leuthold Group

‘Abuse of coverage’

Whereas President Joe Biden and Yellen have insisted that every one the fiscal and financial stimulus isn’t the underlying explanation for inflation, the argument that almost $10 trillion between Congress and the Fed hasn’t pushed costs greater is difficult to swallow for some.

Although Paulsen believes the current circumstances will fade in 2022, he worries about what he calls “world synchronized abuse of coverage.” In essence, the which means is that policymakers stay in emergency posture for an financial image that appears long gone disaster stage, with the potential for boiling over ought to officers proceed to show up the warmth.

Nonetheless, he additionally sees declining commodity costs – with oil on the middle – in addition to falling delivery prices and the lessening of clogs on the ports as hopeful indicators that inflation will, at the least in historic phrases, show non permanent.

“What if someday subsequent yr we not solely declare pseudo-victory over Covid, however we declare it over inflation, too?” Paulsen mentioned.

The emergence of a brand new Covid variant in South Africa complicates each questions. Even Powell, Bush and others within the inflation-is-transitory camp say that the pandemic has been the foundation explanation for value pressures, so if the brand new variant turns into a bigger menace, which means inflation stays greater for longer.

Beside that, although, most mainstream economists are sticking to the idea that 2022 will say a big drop in inflation.

The way it all ends

Mark Zandi, the chief economist at Moody’s Analytics, feels that approach though he says there are shut parallels between the present predicament and the runaway inflation of the Nineteen Seventies.

For one, he mentioned the waves in that inflation shock have been each demand-driven and the product of provide points due to the oil embargoes again then. Unions that have been in a position to negotiate value of dwelling will increase in contracts additionally boosted the wage-price spiral.

A sentient Fed additionally contributed to the issues by taking inflation too flippantly and resisting the rate of interest hikes that might have slowed the financial system.

Whereas Fed policymakers have been gradual to tighten within the current day, they’ve vowed that if inflation expectations change into unhinged, they’re going to act. The fear, although, is that the Fed is already too late.

“The wage spiral that we suffered again then was due to the COLAs and the explosion if inflation expectations. They did rise and the Fed didn’t acknowledge that and didn’t reply to it,” Zandi mentioned. “Assuming every future wave of the virus is much less disruptive, then, yeah, I feel we’d see indicators of moderation.”

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc  Dogecoin

Dogecoin  WhiteBIT Coin

WhiteBIT Coin  USDS

USDS  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  Ethena USDe

Ethena USDe  Canton

Canton  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Rain

Rain  sUSDS

sUSDS  Hedera

Hedera  Dai

Dai  Litecoin

Litecoin  Coinbase Wrapped BTC

Coinbase Wrapped BTC  PayPal USD

PayPal USD  Avalanche

Avalanche  Zcash

Zcash  WETH

WETH  Sui

Sui  Toncoin

Toncoin  Shiba Inu

Shiba Inu  USDT0

USDT0  Cronos

Cronos  Tether Gold

Tether Gold  World Liberty Financial

World Liberty Financial  MemeCore

MemeCore  Polkadot

Polkadot  PAX Gold

PAX Gold  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  OKB

OKB  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Circle USYC

Circle USYC  Pi Network

Pi Network  Aave

Aave  Bittensor

Bittensor  Sky

Sky  Falcon USD

Falcon USD  Global Dollar

Global Dollar  Aster

Aster  NEAR Protocol

NEAR Protocol  syrupUSDC

syrupUSDC  Ripple USD

Ripple USD  Bitget Token

Bitget Token  Pepe

Pepe  HTX DAO

HTX DAO  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  BFUSD

BFUSD  Ondo

Ondo  Pump.fun

Pump.fun  Worldcoin

Worldcoin  Gate

Gate  POL (ex-MATIC)

POL (ex-MATIC)  KuCoin

KuCoin  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Midnight

Midnight  Ethena

Ethena  Ondo US Dollar Yield

Ondo US Dollar Yield  Jito Staked SOL

Jito Staked SOL  Cosmos Hub

Cosmos Hub  NEXO

NEXO  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  USDtb

USDtb  Binance-Peg WETH

Binance-Peg WETH  Rocket Pool ETH

Rocket Pool ETH  Aptos

Aptos  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Algorand

Algorand  Filecoin

Filecoin  Wrapped BNB

Wrapped BNB  Function FBTC

Function FBTC  Official Trump

Official Trump

GIPHY App Key not set. Please check settings