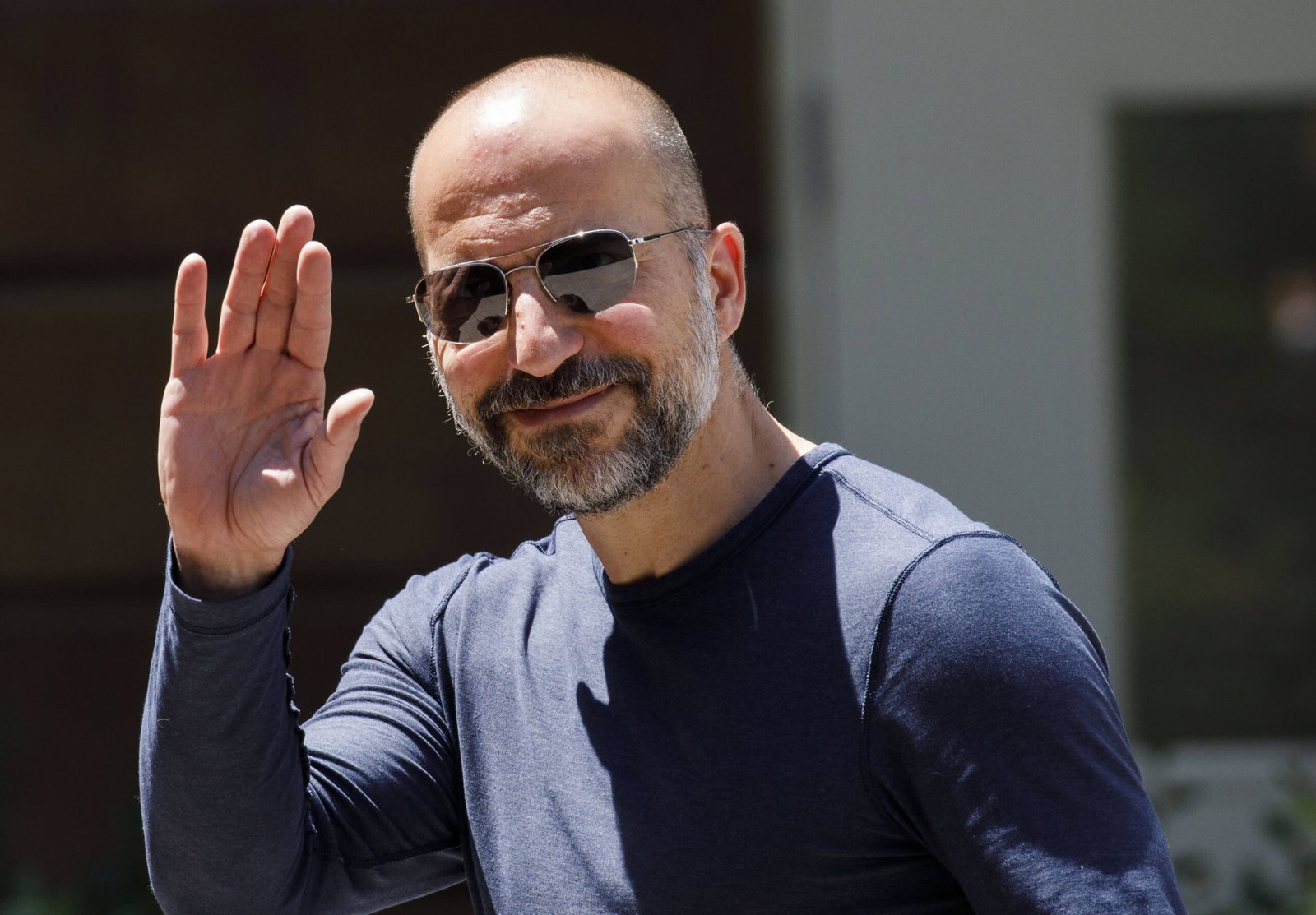

Qualcomm CEO Cristiano Amon.

Carlo Allegri | Reuters

Qualcomm inventory rose greater than 12% on Thursday, sooner or later after it reported September quarter earnings that not solely beat what Wall Avenue anticipated, but additionally included bullish steerage for the December quarter.

A part of the rationale for the sturdy steerage is that Qualcomm, a number one semiconductor firm, is extra optimistic concerning the world chip scarcity than a lot of its rivals. For instance, Apple says chip shortages will value it greater than $6 billion within the December quarter.

Qualcomm CEO Cristiano Amon mentioned on Wednesday that it anticipated its personal provide points to be materially higher by the tip of December and the corporate may have sufficient provide to satisfy demand by the second half of subsequent 12 months.

That is earlier than predictions concerning the finish of worldwide chip scarcity from Intel, which predicts that shortages will persist by means of 2023, and nearer to AMD’s forecast, which says that challenges associated to chip provide will persist till the second half of 2022.

“We had been cautious on Qualcomm forward of provide points however these are fading into the rear view now,” Goldman Sachs analyst Rod Corridor wrote in a notice on Wednesday.

Amon mentioned Qualcomm’s potential to extend chip income 56% throughout a worldwide scarcity was the results of the corporate’s strikes from earlier this 12 months, and that new capability from suppliers that was deliberate months and years in the past is beginning to come on-line.

“Provide labored precisely as we deliberate,” Amon instructed CNBC on Thursday. “Scale helps, we addressed the problem early … we put capability plans in place and it is working precisely as we deliberate.”

Here is why Qualcomm was in a position to navigate the continued chip scarcity and why it is optimistic about subsequent 12 months.

A number of suppliers

Qualcomm’s greatest particular person line of enterprise is in systems-on-a-chip, or SoCs, that mix central processing with mobile connectivity, and are the costliest and most vital part in an Android smartphone. Practically each top-tier Android smartphone makes use of a Qualcomm Snapdragon chip.

Gross sales for handset chips grew 56% yearly within the September quarter, Amon mentioned.

These chips are made utilizing what known as main node processes, or essentially the most superior and capital intensive chip manufacturing strategies. Main node processes create smaller transistors, which might be packed tightly collectively, creating quicker chips that use much less energy and subsequently extra fascinating smartphones.

It seems, Qualcomm is ready to manufacture its processors utilizing two totally different foundries, or chip factories. Presently, Samsung and TSMC are working essentially the most superior main node, known as 5-nanometer, so Qualcomm is shopping for from each.

“We’re one of many few firms which have the power to do multi-sourcing on the main node, and we’ve accomplished plenty of that with our roadmap,” Amon mentioned in April.

That is compared to firms like Apple, which depends on one provider — TSMC — for its personal SoCs.

On Wednesday, Amon credited double sourcing as a serious cause that it was in a position to enhance chip gross sales, and mentioned that the corporate had three totally different elements on sale that had been coming from two sources.

“We act early, we put plenty of issues in place, multi-sourcing, capability expansions, and we mentioned that we count on to see materials enchancment in our provide in direction of the tip of the calendar 12 months,” Amon mentioned Wednesday on a name with analysts.

Match points and transferring upmarket

Nonetheless, different executives have mentioned up to now month the primary concern is not with main node chips, however as an alternative on the less-advanced however nonetheless important chips, like show or energy chips.

Each Intel and AMD’s CEOs have known as this a “match set” concern, the place PC makers “could have the CPU, however you do not have the LCD, or you do not have the Wi-Fi,” as Intel CEO Pat Gelsinger mentioned in an interview final month.

Qualcomm provides extra smartphone makers than PC unique tools producers, however it’s dealing with the identical points, mentioned Qualcomm CFO Akash Palkhiwala.

“We’re positively seeing some mismatch of elements within the short-term at a few of our prospects,” Palkhiwala mentioned. “However you must consider these as actually timing points.”

Qualcomm officers went on to say that when smartphone makers do not have sufficient elements, they prioritize dearer fashions. Premium telephones use Qualcomm’s most superior processors, which value extra, and the corporate is ready to “allocate” its provide capability to prioritize extra worthwhile chips.

Unit gross sales of premium units with essentially the most superior Qualcomm chips elevated 21% within the September quarter, Qualcomm mentioned.

“We’re focusing actually on the premium and high-tier models, and so when our prospects have provide mismatch, they really find yourself supplying the premium in high-tier units,” Palkhiwala mentioned, saying that match points should not “a giant issue” for Qualcomm within the quick time period.

Qualcomm says it nonetheless has provide constraints, and that whereas the corporate would nonetheless “ship extra” if it may make extra, it sees the worldwide chip scarcity going in accordance with its plans.

“We do have constraints actually across-the-board and it’s a must to determine how the demand would have performed out if there was provide throughout the trade,” Palkhiwala mentioned. “However we really feel fairly comfy that the general provide image is enjoying out precisely as we had deliberate.”

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc  Dogecoin

Dogecoin  WhiteBIT Coin

WhiteBIT Coin  USDS

USDS  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  Ethena USDe

Ethena USDe  Canton

Canton  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Rain

Rain  sUSDS

sUSDS  Hedera

Hedera  Dai

Dai  Litecoin

Litecoin  Coinbase Wrapped BTC

Coinbase Wrapped BTC  PayPal USD

PayPal USD  Avalanche

Avalanche  Zcash

Zcash  WETH

WETH  Sui

Sui  Toncoin

Toncoin  Shiba Inu

Shiba Inu  USDT0

USDT0  Cronos

Cronos  Tether Gold

Tether Gold  World Liberty Financial

World Liberty Financial  MemeCore

MemeCore  Polkadot

Polkadot  PAX Gold

PAX Gold  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  OKB

OKB  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Circle USYC

Circle USYC  Pi Network

Pi Network  Bittensor

Bittensor  Aave

Aave  Sky

Sky  Falcon USD

Falcon USD  Aster

Aster  Global Dollar

Global Dollar  NEAR Protocol

NEAR Protocol  syrupUSDC

syrupUSDC  Ripple USD

Ripple USD  Bitget Token

Bitget Token  HTX DAO

HTX DAO  Pepe

Pepe  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  BFUSD

BFUSD  Ondo

Ondo  Pump.fun

Pump.fun  Worldcoin

Worldcoin  Gate

Gate  POL (ex-MATIC)

POL (ex-MATIC)  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  KuCoin

KuCoin  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Midnight

Midnight  Ethena

Ethena  Cosmos Hub

Cosmos Hub  Jito Staked SOL

Jito Staked SOL  Ondo US Dollar Yield

Ondo US Dollar Yield  NEXO

NEXO  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  USDtb

USDtb  Binance-Peg WETH

Binance-Peg WETH  Rocket Pool ETH

Rocket Pool ETH  Aptos

Aptos  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Algorand

Algorand  Wrapped BNB

Wrapped BNB  Filecoin

Filecoin  Function FBTC

Function FBTC  OUSG

OUSG

GIPHY App Key not set. Please check settings