Ethereum underwent an enormous community improve referred to as the merge which proponents say will make transactions rather more vitality environment friendly. Following the merge, ether costs have dropped following an enormous run up forward of the occasion.

Jakub Porzycki | Nurphoto | Getty Photos

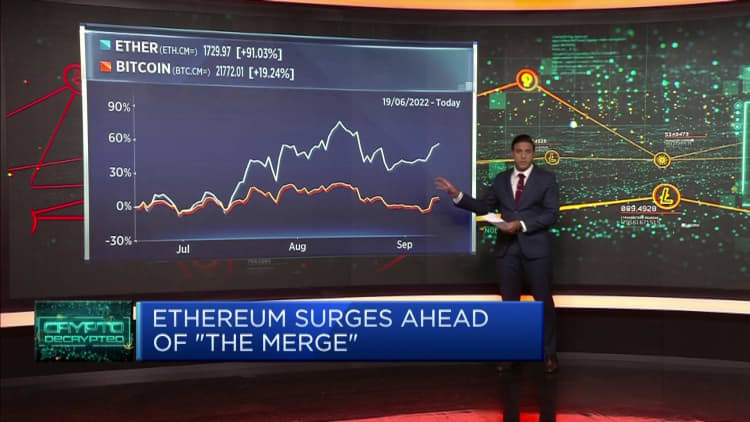

Ether has fallen greater than bitcoin for the reason that cryptocurrency’s underlying expertise, the Ethereum community, underwent an enormous improve referred to as “the merge.”

Ethereum is a blockchain expertise that successfully permits builders to construct apps on high of it. Ether is the native cryptocurrency that runs on Ethereum.

associated investing information

The merge is an improve to Ethereum that modifications the validation mechanism for transactions from a proof-of-work technique to proof-of-stake. Proponents say it will make validating transactions on Ethereum rather more vitality environment friendly. It has been eagerly anticipated by the crypto neighborhood.

Regardless of the improve taking place efficiently, ether has fallen greater than bitcoin.

Since Sept. 15, the date the merge was accomplished, to Tuesday, ether is down round 15%. Bitcoin has dropped round 5% in the identical interval.

Forward of the community improve, the value of ether roughly doubled from the lows of the yr in June, far outpacing bitcoin’s beneficial properties.

Vijay Ayyar, vp of company improvement and worldwide at crypto alternate Luno, stated that the merge was already “priced in” for ether and the “precise occasion was a ‘promote the information’ state of affairs.”

Merchants are additionally shifting investments from ether and different different digital cash again into bitcoin, in accordance with Ayyar, “for the reason that expectation is that Bitcoin will outperform for a couple of months from right here on.”

Buyers are additionally questioning whether or not the regulatory standing of ether could change after the merge after U.S. Securities and Change Fee Chair Gary Gensler indicated final week that cryptocurrencies that work on the proof-of-stake mannequin, which applies to Ethereum, may very well be classed as a safety. That might deliver it beneath the purview of the regulators.

Gensler, whose feedback had been reported by a number of information shops, didn’t identify ether particularly. The proof-of-stake mannequin entails buyers “staking” or locking up their ether and incomes returns for doing so.

“For Ethereum, there may be one other concern: PoS (proof-of-stake) crypto could fall beneath SEC’s scrutiny,” stated Yuya Hasegawa, crypto market analyst at Japanese crypto alternate Bitbank.

Price hikes nonetheless in focus

Crypto buyers are additionally on edge forward of an anticipated rate of interest hike from the U.S. Federal Reserve this week.

Central banks world wide have been elevating rates of interest to take care of rampant inflation. However that has harm threat belongings reminiscent of shares. Cryptocurrencies have been carefully correlated with U.S. inventory markets, particularly the tech-heavy Nasdaq. With shares remaining beneath strain, crypto has additionally felt the warmth.

Inflation within the U.S. in August got here in increased than anticipated, which hit shares and crypto.

“From a macro perspective as effectively, inflation did are available in increased, and therefore brought on a dump throughout all markets, however ethereum and altcoins did dump more durable, given they’re alongside the extra dangerous a part of the crypto spectrum,” Ayyar stated.

Bitcoin has been buying and selling in a variety of about $18,000 to $25,000 since June, a stage at which buyers are shopping for in, in accordance with Ayyar.

However any “change within the macro setting by way of inflation of rate of interest surprises, is unquestionably trigger for concern,” he stated, including that if bitcoin falls beneath $18,000, the cryptocurrency may check ranges as little as $14,000.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Bitcoin Cash

Bitcoin Cash  WhiteBIT Coin

WhiteBIT Coin  Cardano

Cardano  USDS

USDS  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Ethena USDe

Ethena USDe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  Canton

Canton  Monero

Monero  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Zcash

Zcash  sUSDS

sUSDS  Hedera

Hedera  Litecoin

Litecoin  Dai

Dai  Coinbase Wrapped BTC

Coinbase Wrapped BTC  PayPal USD

PayPal USD  Avalanche

Avalanche  Shiba Inu

Shiba Inu  WETH

WETH  Sui

Sui  Toncoin

Toncoin  Rain

Rain  USDT0

USDT0  Cronos

Cronos  World Liberty Financial

World Liberty Financial  Tether Gold

Tether Gold  PAX Gold

PAX Gold  MemeCore

MemeCore  Polkadot

Polkadot  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  Aave

Aave  Pepe

Pepe  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Aster

Aster  Bittensor

Bittensor  Falcon USD

Falcon USD  Bitget Token

Bitget Token  OKB

OKB  Pi Network

Pi Network  Circle USYC

Circle USYC  syrupUSDC

syrupUSDC  Global Dollar

Global Dollar  HTX DAO

HTX DAO  Sky

Sky  Ripple USD

Ripple USD  Ethereum Classic

Ethereum Classic  NEAR Protocol

NEAR Protocol  Ondo

Ondo  BFUSD

BFUSD  Internet Computer

Internet Computer  Pump.fun

Pump.fun  POL (ex-MATIC)

POL (ex-MATIC)  Worldcoin

Worldcoin  Gate

Gate  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Quant

Quant  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Ethena

Ethena  Midnight

Midnight  Jito Staked SOL

Jito Staked SOL  Algorand

Algorand  USDtb

USDtb  NEXO

NEXO  Binance-Peg WETH

Binance-Peg WETH  Rocket Pool ETH

Rocket Pool ETH  Official Trump

Official Trump  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Render

Render  Wrapped BNB

Wrapped BNB  Function FBTC

Function FBTC

GIPHY App Key not set. Please check settings