U.S. shares rose barely on Tuesday as buyers appeared ahead to a pivotal Federal Reserve determination.

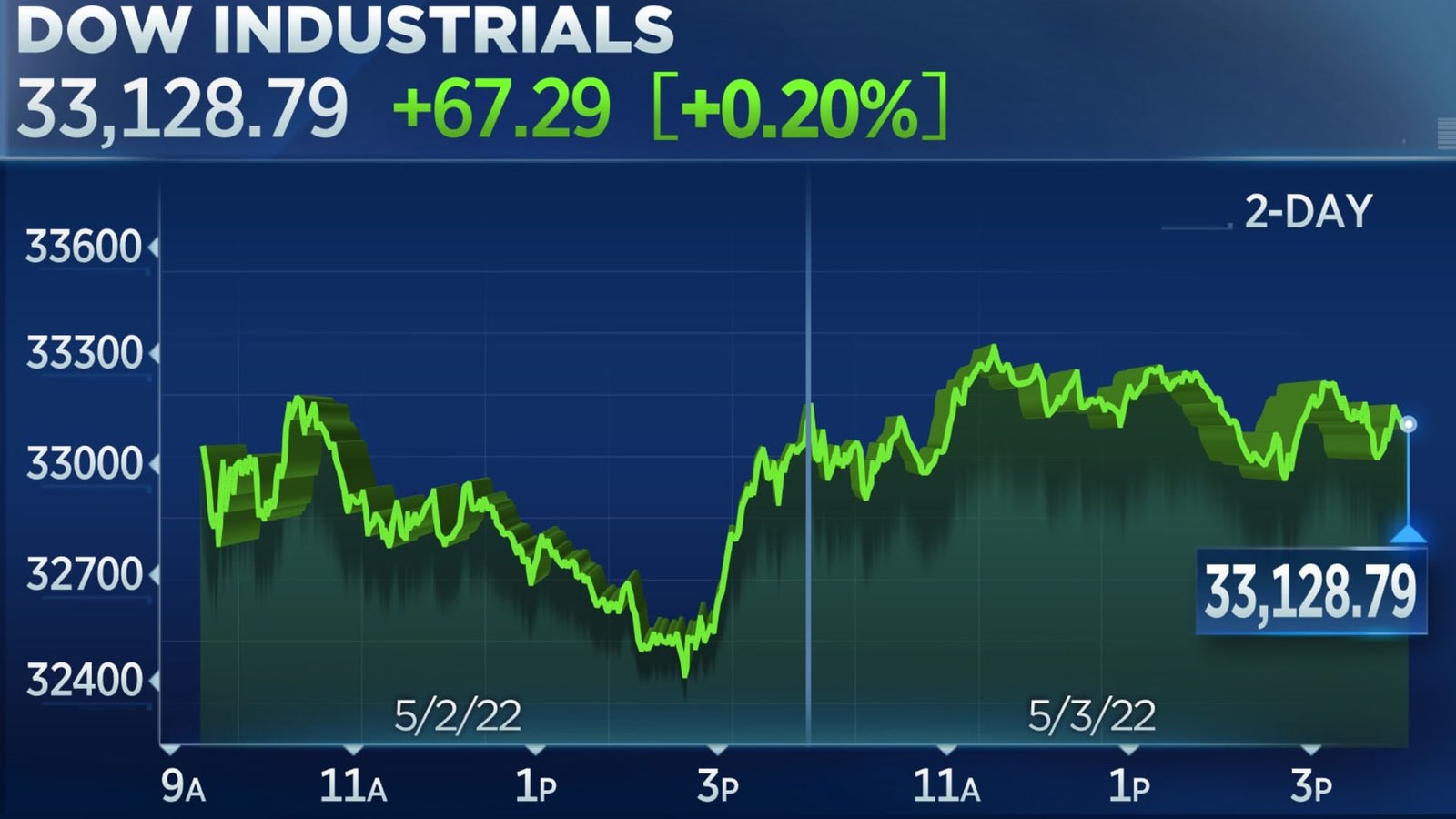

The S&P 500 rose 0.48% to 4,175.48. The Dow Jones Industrial Common gained 67.29 factors, or 0.20%, to shut at 33,128.79. The tech-heavy Nasdaq Composite added 0.22% to complete at 12,563.76.

Tuesday’s positive factors constructed on a late rally from the earlier session, which noticed all three main averages erase sizable losses to shut greater for the day.

“For the primary time in a number of days, sellers seem exhausted, and shorts are a bit nervous than longs (there aren’t many individuals who really feel ‘the’ backside is in, however even bears are anxious a couple of sharp rebound rally),” Adam Crisafulli of Important Data stated in a be aware to purchasers.

These optimistic strikes for shares come forward of a extensively anticipated Federal Reserve determination on Wednesday.

Wall Road is essentially anticipating the central financial institution to boost charges by 50 foundation factors this week, whereas some buyers consider expectations of aggressive financial tightening from the central financial institution are already priced into markets.

Billionaire hedge fund supervisor Paul Tudor Jones stated on CNBC’s “Squawk Field” Tuesday that, with the Fed tightening and indicators that the financial system is slowing, capital preservation must be the principle objective for buyers.

“You possibly can’t consider a worse surroundings than the place we’re proper now for monetary belongings. Clearly you do not need to personal bonds and shares,” Jones stated.

Tuesday’s positive factors had been broad within the S&P 500, however led by the power sector. Exxon Mobil added greater than 2%, and EOG Assets rose 3.8%. Defensive sectors comparable to well being care and utilities additionally outperformed, with Pfizer gaining practically 2% after reporting a stronger-than-expected first quarter.

Financials had been one other shiny spot, with JPMorgan and Morgan Stanley every rising greater than 2%.

Shares are coming off a brutal stretch of weeks. April was the worst month since March 2020 for the Dow and S&P 500. It was the worst month for the Nasdaq since 2008.

“We expect the information continues to color an image of maximum concern and a contrarian alternative for longer-term buyers, although there’s scope for additional motion/extra draw back within the very close to time period on some gauges,” RBC strategist Lori Calvasina stated in a be aware to purchasers.

The S&P 500 is buying and selling in correction territory, down about 13% from its report highs, however the measurement and size of this drawdown is consistent with historic corrections, in accordance with LPL Monetary.

The anticipated price hike comes as there are rising considerations concerning the international financial system, due partially to China’s lockdowns and the warfare in Europe.

“Markets proceed to be hostage to the China Covid-19 response and the geopolitics, that are overshadowing what continues to be a really resilient elementary image,” JPMorgan strategist Mislav Matejka stated in a be aware to purchasers.

The benchmark 10-year Treasury yield retreated after hitting a brand new milestone on Monday. The bond yield hit 3.01% throughout the earlier session, its highest level since December 2018, however fell again beneath the three% degree on Tuesday.

Company earnings stories had been spurring particular person inventory strikes on Tuesday.

Chegg’s inventory value plummeted roughly 30% after the textbook firm issued weak steering for the complete yr regardless of exceeding earnings expectations. Expedia and Hilton tumbled 14% and about 4.2%, respectively, after their quarterly stories.

On the optimistic facet, shares of Clorox rose practically 3% after the corporate’s fiscal third-quarter outcomes topped expectations. Chemical inventory Chemours surged greater than 17% after the corporate raised its steering and confirmed success elevating costs.

There have been some optimistic indicators for the financial system on the information entrance. Manufacturing unit orders for March rose 2.2%, higher than anticipated. Job openings got here in at 11.5 million, an all-time excessive.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  USDC

USDC  XRP

XRP  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Toncoin

Toncoin  Cardano

Cardano  TRON

TRON  Avalanche

Avalanche  Wrapped Bitcoin

Wrapped Bitcoin  Shiba Inu

Shiba Inu  Chainlink

Chainlink  Polkadot

Polkadot  Bitcoin Cash

Bitcoin Cash  NEAR Protocol

NEAR Protocol  Uniswap

Uniswap  LEO Token

LEO Token  Litecoin

Litecoin  Dai

Dai  Pepe

Pepe  Wrapped eETH

Wrapped eETH  Polygon

Polygon  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  Aptos

Aptos  Ethena USDe

Ethena USDe  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Stellar

Stellar  Monero

Monero  Stacks

Stacks  Mantle

Mantle  Filecoin

Filecoin  dogwifhat

dogwifhat  Render

Render  Injective

Injective  Bittensor

Bittensor  OKB

OKB  Hedera

Hedera  Cronos

Cronos  Maker

Maker  Immutable

Immutable  Arbitrum

Arbitrum  Cosmos Hub

Cosmos Hub  First Digital USD

First Digital USD  Bonk

Bonk  Arweave

Arweave  Sui

Sui  Optimism

Optimism  The Graph

The Graph  Rocket Pool ETH

Rocket Pool ETH  FLOKI

FLOKI  Renzo Restaked ETH

Renzo Restaked ETH  THORChain

THORChain  Mantle Staked Ether

Mantle Staked Ether  Theta Network

Theta Network  WhiteBIT Coin

WhiteBIT Coin  Notcoin

Notcoin  Aave

Aave  Jupiter

Jupiter  Ondo

Ondo  Pyth Network

Pyth Network  JasmyCoin

JasmyCoin  Lido DAO

Lido DAO  Fantom

Fantom  Brett

Brett  Core

Core  Celestia

Celestia  Algorand

Algorand  Sei

Sei  ether.fi Staked ETH

ether.fi Staked ETH  Quant

Quant  Flow

Flow  Gate

Gate  MANTRA

MANTRA  Marinade Staked SOL

Marinade Staked SOL  KuCoin

KuCoin  Popcat

Popcat  Beam

Beam  MultiversX

MultiversX  Axie Infinity

Axie Infinity  Bitcoin SV

Bitcoin SV  Helium

Helium  GALA

GALA  Ethereum Name Service

Ethereum Name Service  BitTorrent

BitTorrent  EOS

EOS  Tokenize Xchange

Tokenize Xchange  NEO

NEO  ORDI

ORDI  Akash Network

Akash Network  dYdX

dYdX

GIPHY App Key not set. Please check settings