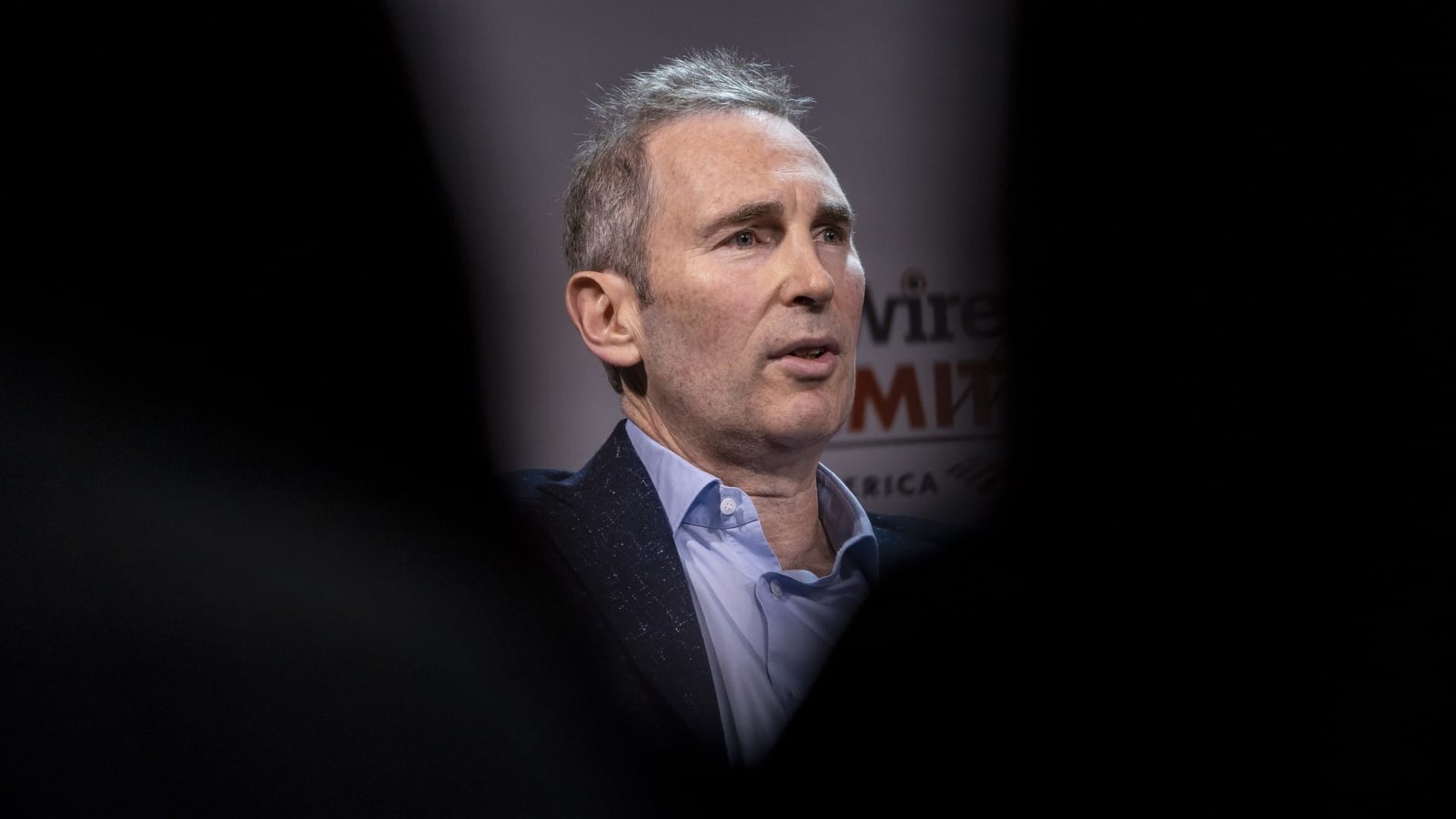

Amazon CEO Andy Jassy speaks through the GeekWire Summit in Seattle on Oct. 5, 2021.

David Ryder | Bloomberg | Getty Pictures

Cloud corporations, e-retailers and family tech names bought hammered on Thursday, wiping out a whole lot of billions of {dollars} in market worth and pushing the Nasdaq Composite to its worst one-day plunge since June 2020.

A day after the Federal Reserve raised its benchmark rate of interest by a half level in a bid to stem rising inflation, traders bought out of the a part of the market that is usually seen as the expansion driver, on considerations that the economic system is in for some darkish instances forward.

Massive Tech suffered a large sell-off, with Amazon dropping virtually 8% and Fb proprietor Meta Platforms off about 7%. Amongst different large names: Apple fell practically 6%; Google guardian Alphabet declined about 5%; and Microsoft shares slid 4%. General, the Nasdaq plummeted 5%.

Traders have been significantly down on e-commerce after Shopify, which ballooned through the pandemic by serving to bodily retailers go digital, reported disappointing first-quarter earnings and income. The inventory tumbled 15%. Ebay and Etsy additionally suffered double-digit drops following their earnings studies.

The rotation out of tech started in late 2021 as hovering inflation and the specter of rising charges led traders to areas of the economic system deemed safer like vitality and monetary providers. An additional blow got here with Russia’s invasion of Ukraine in February, which despatched vitality costs larger and heightened considerations about provide chain constraints and weakening enterprise situations in lots of components of the world.

The primary quarter of the yr was the worst interval for the Nasdaq for the reason that similar three months in 2020, when the early days of the pandemic spurred an financial shutdown. The tech-heavy index fell 9.1% through the first quarter. Lower than midway by the second quarter, the Nasdaq is now down 21% for the yr.

Cloud shares, which additionally turned a favourite throughout Covid as firms tapped providers they may use remotely, have been hit exhausting as effectively on Thursday. Invoice-payment software program developer Invoice.com noticed shares plunge 13%, whereas undertaking administration software program firm Asana’s inventory fell 11%.

The WisdomTree Cloud Computing Fund was down practically 8%, its steepest every day decline since September 2020.

Covid winners getting crushed

CNBC

For sure Covid winners like Netflix, Zoom, Peloton and Twilio, the reversal of fortune has been much more dramatic than the run-up. Every of them is down greater than 45% yr to this point, and their slumps deepened Thursday.

The market initially responded positively to the Fed’s commentary on Wednesday, after Chair Jerome Powell stated the Federal Open Market Committee wasn’t actively contemplating a fee hike any larger than a half level. Nonetheless, the prospects of continued fee will increase led to unfavourable sentiment on Thursday, sending shares down throughout the board.

WATCH: Money might be the most secure place proper now, says Barclays’ Deshpande

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  USDC

USDC  XRP

XRP  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Toncoin

Toncoin  Cardano

Cardano  TRON

TRON  Avalanche

Avalanche  Wrapped Bitcoin

Wrapped Bitcoin  Shiba Inu

Shiba Inu  Chainlink

Chainlink  Polkadot

Polkadot  Bitcoin Cash

Bitcoin Cash  NEAR Protocol

NEAR Protocol  Uniswap

Uniswap  LEO Token

LEO Token  Litecoin

Litecoin  Dai

Dai  Pepe

Pepe  Wrapped eETH

Wrapped eETH  Polygon

Polygon  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  Aptos

Aptos  Ethena USDe

Ethena USDe  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Stellar

Stellar  Monero

Monero  Stacks

Stacks  Mantle

Mantle  Filecoin

Filecoin  Render

Render  dogwifhat

dogwifhat  Injective

Injective  Bittensor

Bittensor  OKB

OKB  Hedera

Hedera  Cronos

Cronos  Maker

Maker  Immutable

Immutable  Arbitrum

Arbitrum  Cosmos Hub

Cosmos Hub  First Digital USD

First Digital USD  Bonk

Bonk  Arweave

Arweave  Sui

Sui  Optimism

Optimism  The Graph

The Graph  Rocket Pool ETH

Rocket Pool ETH  FLOKI

FLOKI  Renzo Restaked ETH

Renzo Restaked ETH  THORChain

THORChain  Mantle Staked Ether

Mantle Staked Ether  Theta Network

Theta Network  WhiteBIT Coin

WhiteBIT Coin  Notcoin

Notcoin  Aave

Aave  Jupiter

Jupiter  Ondo

Ondo  Pyth Network

Pyth Network  JasmyCoin

JasmyCoin  Lido DAO

Lido DAO  Fantom

Fantom  Brett

Brett  Core

Core  Celestia

Celestia  Algorand

Algorand  Sei

Sei  ether.fi Staked ETH

ether.fi Staked ETH  Quant

Quant  Flow

Flow  Gate

Gate  MANTRA

MANTRA  Marinade Staked SOL

Marinade Staked SOL  Popcat

Popcat  KuCoin

KuCoin  Beam

Beam  MultiversX

MultiversX  Bitcoin SV

Bitcoin SV  Axie Infinity

Axie Infinity  Helium

Helium  GALA

GALA  Ethereum Name Service

Ethereum Name Service  BitTorrent

BitTorrent  EOS

EOS  Tokenize Xchange

Tokenize Xchange  NEO

NEO  ORDI

ORDI  Akash Network

Akash Network  dYdX

dYdX

GIPHY App Key not set. Please check settings