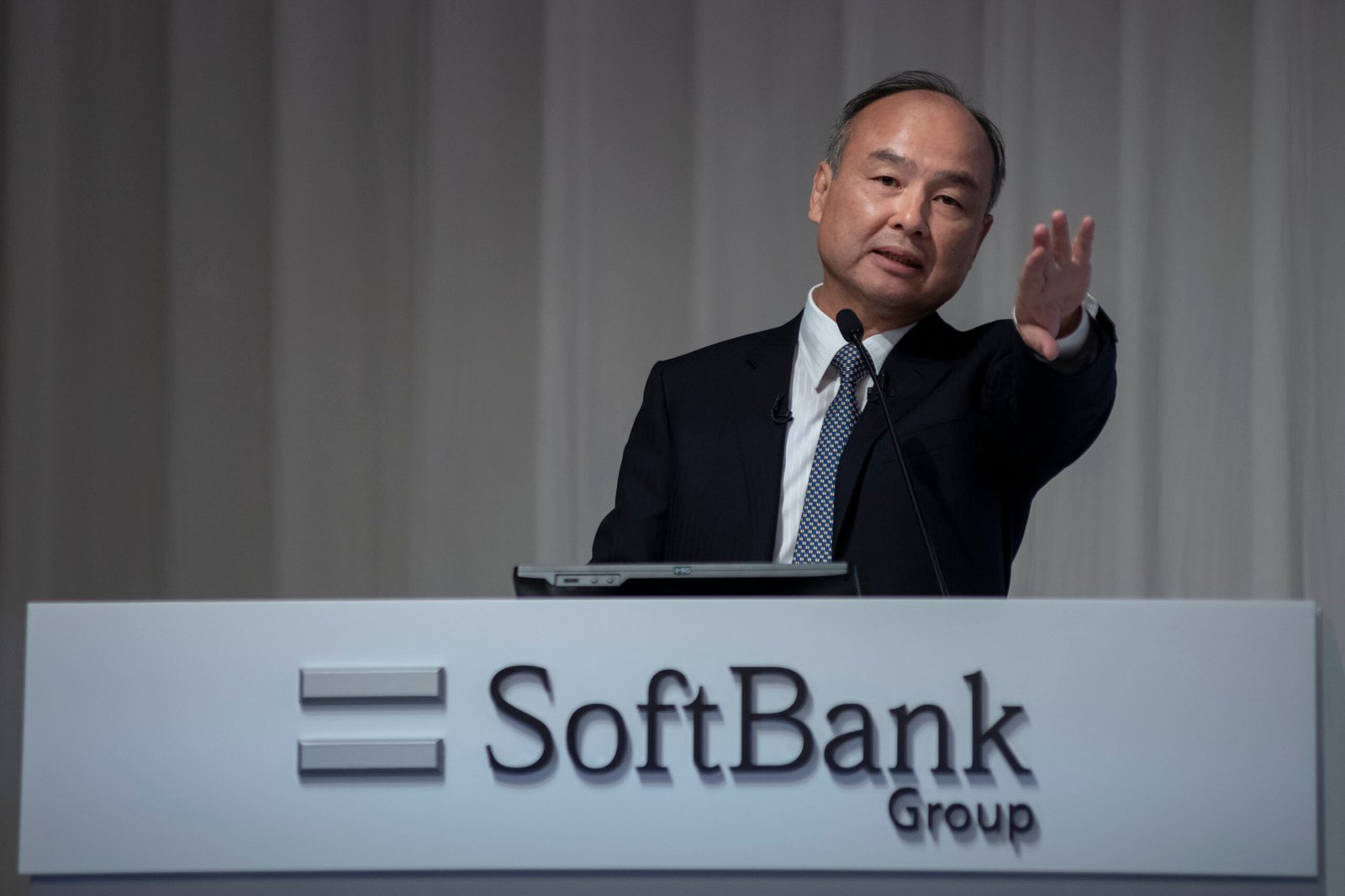

SoftBank Group founder, chairman and CEO Masayoshi Son publicizes his group’s earnings outcomes on Could 9, 2019, in Tokyo.

Alessandro Di Ciommo | NurPhoto | Getty Pictures

SoftBank Group shares fell by greater than 8% Monday as the worth of its portfolio corporations continued to slip.

The Japanese tech large’s share worth fell from 5201 yen ($46) to 5103 yen on the Tokyo inventory market. At one level, shares fell as little as 5,062 yen, their lowest degree since June 2020.

The autumn in SoftBank’s share worth, which marks its seventh consecutive day of losses, comes amid a interval of uncertainty round a number of the firm’s greatest bets and a broader regional sell-off of tech shares in Asia.

Chinese language e-commerce agency Alibaba — SoftBank’s most beneficial firm — noticed its market cap fall by a number of billion {dollars} Monday after the corporate introduced a restructure.

Alibaba’s Hong Kong-traded shares plummeted over 8% after it revealed plans to kind two new models to accommodate its major e-commerce companies — worldwide digital commerce and China digital commerce — in a bid to turn into extra agile and speed up development. It additionally mentioned deputy chief monetary officer Toby Xu will turn into the brand new chief monetary officer from April.

The modifications come as Alibaba faces headwinds on a number of fronts, together with elevated competitors, a slowing financial system and a regulatory crackdown.

In the meantime, SoftBank-backed ride-hailing agency Didi Chuxing introduced final week that it plans to de-list from the New York Inventory Trade lower than six months after its IPO. The Chinese language agency mentioned it plans to relist on the Hong Kong Inventory Trade.

Shares of Didi have plunged 57% since its IPO on June 30, and closed at $7.80 on Friday.

In one other blow for SoftBank, the sale of its Cambridge, U.Ok. based-chip designer Arm to Nvidia is wanting growing unlikely. World regulatory scrutiny surrounding the deal has ramped up, with consultants saying the deal is now “extremely unlikely” to undergo.

SoftBank initially agreed to promote the corporate for $40 billion, however the worth of the deal has soared to round $74 billion following a surge in Nvidia’s share worth, based on Bloomberg. As such, the corporate appears to be like to overlook out on a major payday if the deal falls by way of.

SoftBank in ‘the center of a blizzard’

Final month, SoftBank reported a quarterly loss as its Imaginative and prescient Fund unit took a $10 billion hit from a decline within the share worth of its portfolio corporations.

At the same time as the worth of its property fell, SoftBank mentioned its inventory is undervalued and pledged to spend as much as 1 trillion yen shopping for again almost 15% of its shares.

Whereas CEO Masayoshi Son has likened SoftBank to a goose laying “golden eggs,” the latest outcomes underscore the headwinds for the funding enterprise.

“We’re in the midst of a blizzard,” Son informed a information convention on the time, including he was “not proud” of the Imaginative and prescient Fund’s efficiency within the quarter. But he mentioned the corporate was making regular steps to double the numbers of “golden eggs” in comparison with final yr.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  USDC

USDC  XRP

XRP  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Toncoin

Toncoin  Cardano

Cardano  TRON

TRON  Avalanche

Avalanche  Wrapped Bitcoin

Wrapped Bitcoin  Shiba Inu

Shiba Inu  Chainlink

Chainlink  Polkadot

Polkadot  Bitcoin Cash

Bitcoin Cash  NEAR Protocol

NEAR Protocol  Uniswap

Uniswap  LEO Token

LEO Token  Litecoin

Litecoin  Dai

Dai  Pepe

Pepe  Wrapped eETH

Wrapped eETH  Polygon

Polygon  Internet Computer

Internet Computer  Aptos

Aptos  Ethereum Classic

Ethereum Classic  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Ethena USDe

Ethena USDe  Stellar

Stellar  Monero

Monero  Stacks

Stacks  Mantle

Mantle  Render

Render  Filecoin

Filecoin  dogwifhat

dogwifhat  Bittensor

Bittensor  OKB

OKB  Injective

Injective  Hedera

Hedera  Maker

Maker  Cronos

Cronos  Cosmos Hub

Cosmos Hub  Arbitrum

Arbitrum  Immutable

Immutable  Arweave

Arweave  Bonk

Bonk  First Digital USD

First Digital USD  Sui

Sui  Optimism

Optimism  The Graph

The Graph  Rocket Pool ETH

Rocket Pool ETH  FLOKI

FLOKI  Renzo Restaked ETH

Renzo Restaked ETH  Mantle Staked Ether

Mantle Staked Ether  THORChain

THORChain  Jupiter

Jupiter  Theta Network

Theta Network  Aave

Aave  JasmyCoin

JasmyCoin  Notcoin

Notcoin  WhiteBIT Coin

WhiteBIT Coin  Ondo

Ondo  Pyth Network

Pyth Network  Lido DAO

Lido DAO  Brett

Brett  Fantom

Fantom  Core

Core  Celestia

Celestia  Sei

Sei  Algorand

Algorand  ether.fi Staked ETH

ether.fi Staked ETH  Quant

Quant  Flow

Flow  Gate

Gate  MANTRA

MANTRA  Marinade Staked SOL

Marinade Staked SOL  Beam

Beam  KuCoin

KuCoin  MultiversX

MultiversX  Bitcoin SV

Bitcoin SV  Axie Infinity

Axie Infinity  Popcat

Popcat  Helium

Helium  Ethereum Name Service

Ethereum Name Service  GALA

GALA  BitTorrent

BitTorrent  EOS

EOS  ORDI

ORDI  Tokenize Xchange

Tokenize Xchange  NEO

NEO  Akash Network

Akash Network  eCash

eCash

GIPHY App Key not set. Please check settings