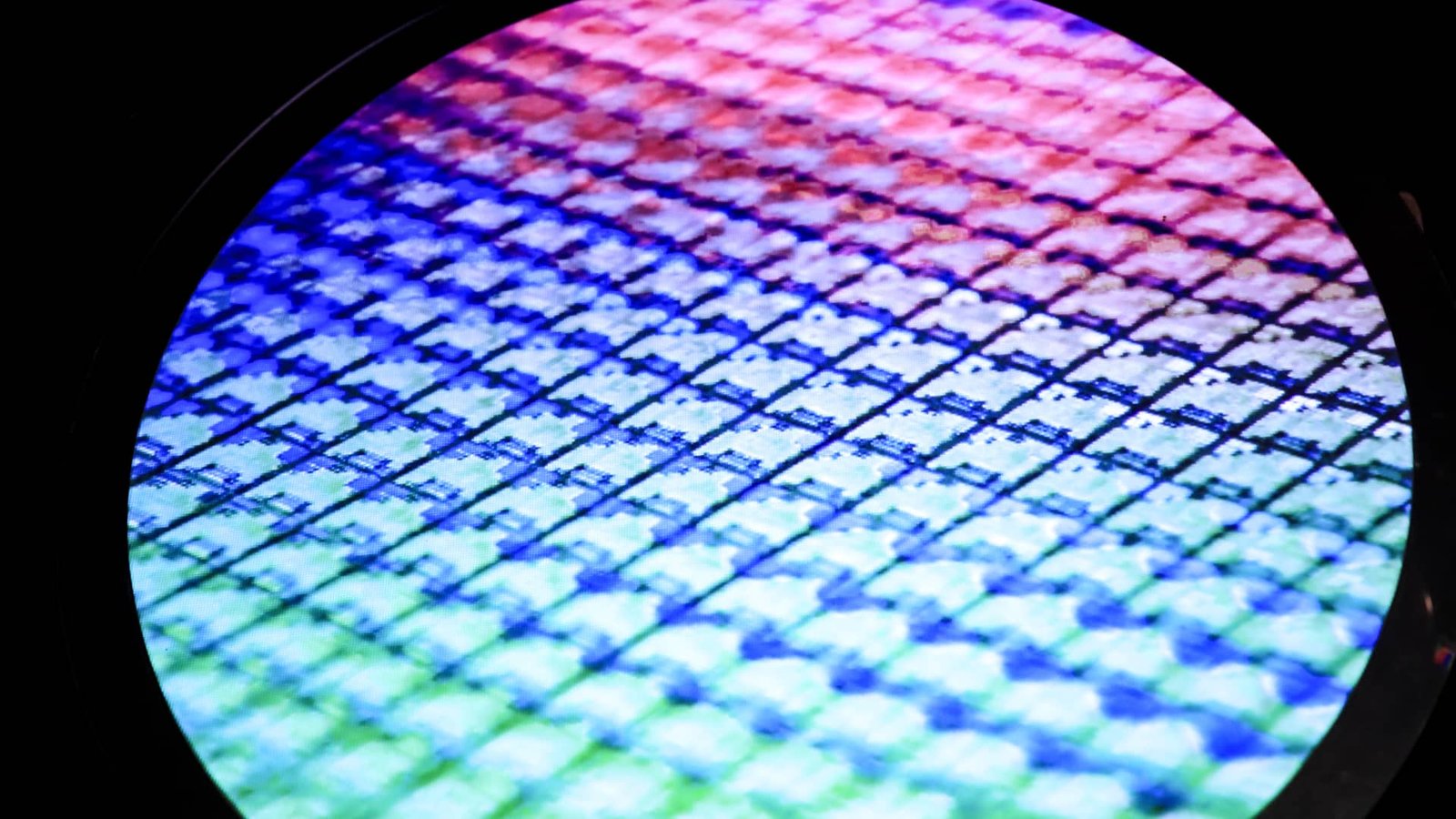

A picture of a semiconductor wafer.

I-Hwa Cheng | Bloomberg | Getty Photographs

Russia’s struggle in Ukraine may see the manufacturing of neon, a important gasoline in superior semiconductor manufacturing, fall to worryingly low ranges at a time when the world is already grappling with a chip scarcity.

Neon is required for the lasers which are utilized in a chip manufacturing course of referred to as lithography, the place machines carve patterns onto tiny items of silicon made by the likes of Samsung, Intel and TSMC.

Greater than half of the world’s neon is produced by a handful of corporations in Ukraine, in line with Peter Hanbury, a semiconductor analyst at analysis agency Bain & Co.

These corporations embody Mariupol-based Ingas, in addition to Cryoin and Iceblick, that are based mostly in Odessa.

The corporations didn’t instantly reply to a CNBC request for remark however Ingas and Cryoin have each ceased operations in current weeks amid assaults from Russian forces, in line with Reuters.

With world-leading Ukrainian corporations having shuttered their operations, neon manufacturing is now set to fall off a cliff because the battle drags on.

Based mostly on estimates from consultancy agency Techcet, worldwide neon consumption for semiconductor manufacturing reached roughly 540 metric tons final yr. Given Ukraine produces over half of the world’s neon, the determine may fall beneath 270 metric tons in 2022 if the nation’s neon producers stay shut.

“Of the supplies utilized in chip-making that might see successful to their provide from the Ukraine battle, it’s neon that poses the best potential problem,” Hanbury instructed CNBC through electronic mail.

The continuing world chip scarcity has already wreaked havoc on provide chains and led to prolonged delays on merchandise similar to new automobiles and video games consoles just like the PlayStation 5.

A possible world neon scarcity now threatens to make issues even worse.

How neon is made

Neon is a byproduct of large-scale metal manufacturing.

It will get produced following the fractional distillation (a chemical separation course of) of liquid air, which is the air that has been cooled to very low temperatures.

“Traditionally, as much as 90% of the neon for the chip trade was produced as a by-product of Russian metal manufacturing and later refined by corporations primarily based mostly in Ukraine,” Hanbury mentioned, pointing to corporations like Cryoin, Ingas, and UMG RT.

Alan Priestley, an analyst at Gartner, instructed CNBC that the majority main chip producers have a number of months of neon in reserve, including that it is not a significant challenge for them but.

Intel mentioned it’s monitoring the scenario intently. “Intel has assessed the doable affect of the Russia-Ukraine battle on its provide chain,” a spokesperson instructed CNBC.

They added: “Intel’s technique of getting a various, world provide chain minimizes its danger from potential native interruptions. We proceed to observe the scenario rigorously.”

TSMC declined to remark and Samsung didn’t instantly reply to a CNBC request for remark.

“Some smaller fabs with restricted provide could also be affected earlier,” Priestley mentioned. Chip producers are working with their provide chains to attempt to reduce the impacts, he added.

Getting ready for a neon scarcity

The worldwide semiconductor trade has been making ready for an occasion like this for years.

It took essential steps to attempt to restrict future dangers related to neon provides within the wake of Russia’s annexation of Crimea in 2014.

“Following the Crimean annexation, the chip sector acted to chop the necessity to be used of neon within the manufacturing course of,” Hanbury mentioned. “On the similar time, steps have been taken to extend shares of the gasoline at two factors within the provide chain, so each gasoline suppliers and semiconductor makers every usually now have three to 12 months provide at hand.”

New suppliers exterior of Ukraine and Russia have been additionally put in place by semiconductor producers, Hanbury added.

“We estimate solely about two-fifths of the neon utilized in world semiconductor manufacturing right this moment is sourced from Russia and Ukraine,” Hanbury added.

Dutch agency ASML, which makes the extremely complicated lithography machines utilized by the chip giants, diminished its reliance on neon sourced from Ukraine to roughly 20% of earlier ranges, Hanbury added.

A spokesperson for ASML instructed CNBC: “ASML acknowledges the significance of being ready with a view to handle unplanned occasions together with conflicts after they may affect our provide chain.”

They added: “We proceed to intently monitor the standing of the battle and are at present investigating along with our suppliers what the affect (if any) could be and to what extent our suppliers can use different sources if crucial.”

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  USDC

USDC  XRP

XRP  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Toncoin

Toncoin  Cardano

Cardano  TRON

TRON  Avalanche

Avalanche  Wrapped Bitcoin

Wrapped Bitcoin  Shiba Inu

Shiba Inu  Chainlink

Chainlink  Polkadot

Polkadot  Bitcoin Cash

Bitcoin Cash  NEAR Protocol

NEAR Protocol  Uniswap

Uniswap  LEO Token

LEO Token  Litecoin

Litecoin  Dai

Dai  Pepe

Pepe  Wrapped eETH

Wrapped eETH  Polygon

Polygon  Internet Computer

Internet Computer  Aptos

Aptos  Ethereum Classic

Ethereum Classic  Ethena USDe

Ethena USDe  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Stellar

Stellar  Monero

Monero  Stacks

Stacks  Mantle

Mantle  Render

Render  Filecoin

Filecoin  dogwifhat

dogwifhat  OKB

OKB  Bittensor

Bittensor  Injective

Injective  Maker

Maker  Hedera

Hedera  Cronos

Cronos  Cosmos Hub

Cosmos Hub  Arbitrum

Arbitrum  Immutable

Immutable  Arweave

Arweave  Bonk

Bonk  First Digital USD

First Digital USD  Sui

Sui  Optimism

Optimism  The Graph

The Graph  Rocket Pool ETH

Rocket Pool ETH  FLOKI

FLOKI  Renzo Restaked ETH

Renzo Restaked ETH  Mantle Staked Ether

Mantle Staked Ether  THORChain

THORChain  Jupiter

Jupiter  Theta Network

Theta Network  Aave

Aave  Notcoin

Notcoin  WhiteBIT Coin

WhiteBIT Coin  JasmyCoin

JasmyCoin  Ondo

Ondo  Pyth Network

Pyth Network  Lido DAO

Lido DAO  Brett

Brett  Fantom

Fantom  Core

Core  Celestia

Celestia  Algorand

Algorand  Sei

Sei  ether.fi Staked ETH

ether.fi Staked ETH  Quant

Quant  Flow

Flow  Gate

Gate  MANTRA

MANTRA  Marinade Staked SOL

Marinade Staked SOL  Beam

Beam  KuCoin

KuCoin  MultiversX

MultiversX  Axie Infinity

Axie Infinity  Bitcoin SV

Bitcoin SV  Helium

Helium  Popcat

Popcat  Ethereum Name Service

Ethereum Name Service  GALA

GALA  BitTorrent

BitTorrent  EOS

EOS  Tokenize Xchange

Tokenize Xchange  NEO

NEO  ORDI

ORDI  Akash Network

Akash Network  dYdX

dYdX

GIPHY App Key not set. Please check settings