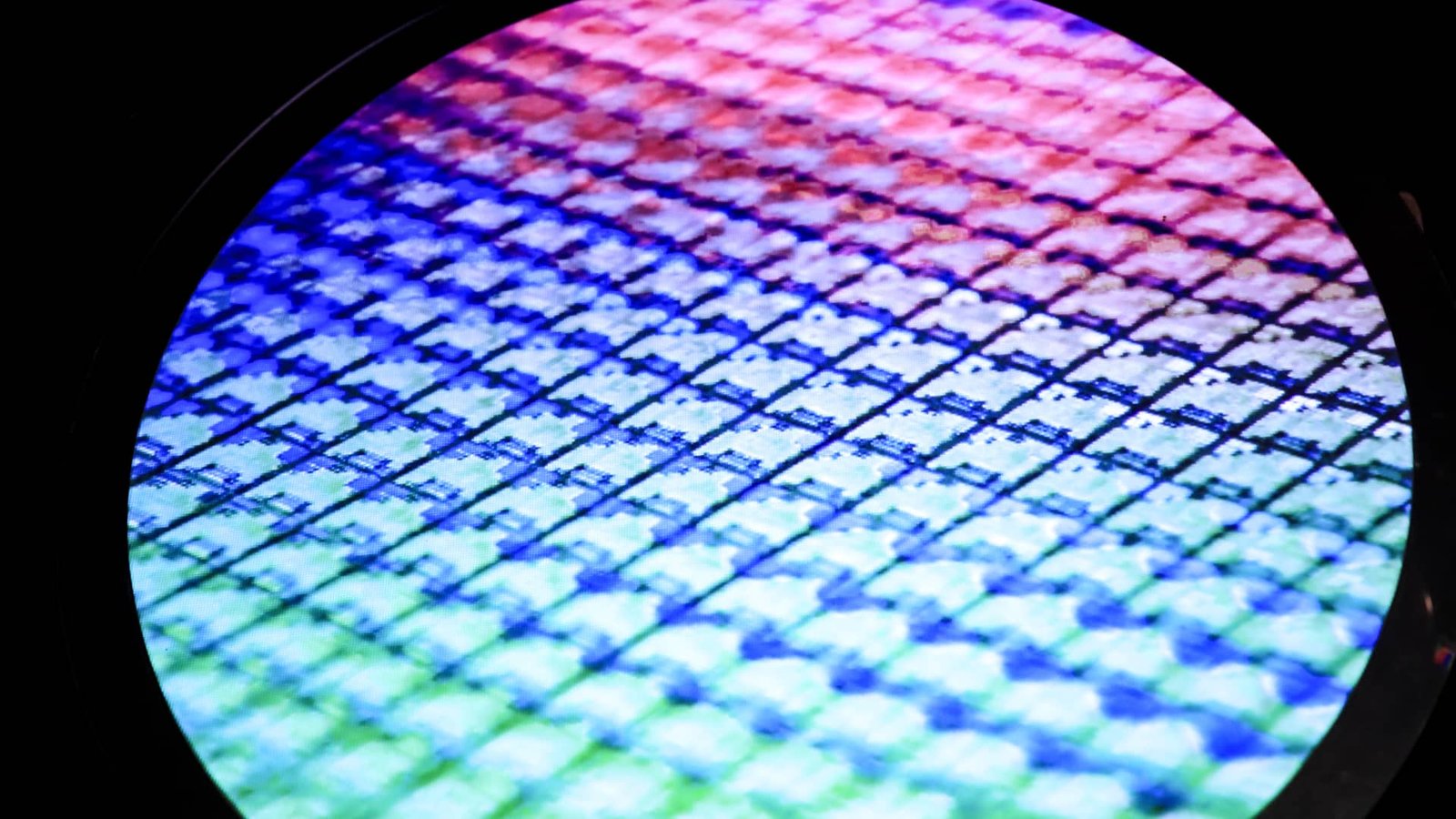

Pat Gelsinger, CEO, of Intel Company, holds a semiconductor chip whereas testifying throughout the Senate Commerce, Science, and Transportation listening to titled Growing Subsequent Era Expertise for Innovation, in Russell Senate Workplace Constructing on Wednesday, March 23, 2022.

Tom Williams | CQ-Roll Name, Inc. | Getty Pictures

Semiconductor shares rose on Thursday as traders regained their urge for food for riskier property and acquired into bullish commentary this week from Nvidia and Intel.

Chip shares have been whacked thus far this yr on inflation fears and issues that the disaster in Ukraine will add to provide chain challenges. By way of Wednesday’s shut, the iShares Semiconductor ETF was down 15% in 2022, whereas the Nasdaq and S&P 500 had dropped 12% and 6.8%, respectively.

Nvidia led the rally on Thursday, climbing 9.8%, its finest day since November. Earlier this week, Nvidia stated at its investor day that the corporate’s roadmap consists of new server chips with an emphasis on synthetic intelligence, in addition to a plan to construct the world’s quickest AI supercomputer.

Analysts appreciated what they heard.

“Essentially we proceed to consider Nvidia is uniquely suited to learn from the expansion of AI in {hardware} and probably software program,” wrote Deutsche Financial institution’s Ross Seymore, who recommends holding the shares, in a be aware on Wednesday.

Intel jumped slightly below 7% on Thursday, which is its largest single-day achieve in additional than yr. CEO Pat Gelsinger was on Capitol Hill on Wednesday to make the case that authorities subsidies for home manufacturing would enhance American nationwide safety and will assist repair the present scarcity of semiconductors that is roiling the automotive trade and different key areas of the financial system.

“Oil reserves have outlined geopolitics for the final 5 a long time,” Gelsinger stated in an interview on CNBC. “The place the fabs are for a digital future is extra essential,” he added, referring to semiconductor vegetation.

Intel plans to spend a minimum of $20 billion on a chip manufacturing unit complicated in Ohio and this month introduced plans to spend $36 billion to construct a brand new “mega manufacturing unit” in Germany in addition to different European hubs.

“Let’s construct them the place we wish them, and outline the world that we need to be a part of within the U.S. and Europe,” Gelsinger stated.

The chip rally was aided by a Labor Division report that confirmed preliminary jobless claims final week dropped to the bottom since 1969. Buyers snapped up shares of firms poised to learn from a U.S. financial restoration.

AMD rose over 5% on Thursday, whereas Broadcom gained 4.5% and Qualcomm rose over 3%. They’re all nonetheless down for the yr.

WATCH: Purchase the dip and keep lengthy Nvidia, Cramer says

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  USDC

USDC  XRP

XRP  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Toncoin

Toncoin  Cardano

Cardano  TRON

TRON  Avalanche

Avalanche  Wrapped Bitcoin

Wrapped Bitcoin  Shiba Inu

Shiba Inu  Chainlink

Chainlink  Polkadot

Polkadot  Bitcoin Cash

Bitcoin Cash  NEAR Protocol

NEAR Protocol  Uniswap

Uniswap  LEO Token

LEO Token  Litecoin

Litecoin  Dai

Dai  Pepe

Pepe  Wrapped eETH

Wrapped eETH  Polygon

Polygon  Internet Computer

Internet Computer  Aptos

Aptos  Ethereum Classic

Ethereum Classic  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Ethena USDe

Ethena USDe  Stellar

Stellar  Monero

Monero  Stacks

Stacks  Mantle

Mantle  Render

Render  Filecoin

Filecoin  dogwifhat

dogwifhat  Bittensor

Bittensor  OKB

OKB  Injective

Injective  Hedera

Hedera  Maker

Maker  Cronos

Cronos  Cosmos Hub

Cosmos Hub  Arbitrum

Arbitrum  Immutable

Immutable  Arweave

Arweave  Bonk

Bonk  First Digital USD

First Digital USD  Sui

Sui  Optimism

Optimism  The Graph

The Graph  Rocket Pool ETH

Rocket Pool ETH  FLOKI

FLOKI  Renzo Restaked ETH

Renzo Restaked ETH  Mantle Staked Ether

Mantle Staked Ether  THORChain

THORChain  Jupiter

Jupiter  Theta Network

Theta Network  Aave

Aave  JasmyCoin

JasmyCoin  Notcoin

Notcoin  WhiteBIT Coin

WhiteBIT Coin  Ondo

Ondo  Pyth Network

Pyth Network  Lido DAO

Lido DAO  Brett

Brett  Fantom

Fantom  Core

Core  Celestia

Celestia  Sei

Sei  Algorand

Algorand  ether.fi Staked ETH

ether.fi Staked ETH  Quant

Quant  Flow

Flow  Gate

Gate  MANTRA

MANTRA  Marinade Staked SOL

Marinade Staked SOL  Beam

Beam  KuCoin

KuCoin  MultiversX

MultiversX  Bitcoin SV

Bitcoin SV  Axie Infinity

Axie Infinity  Popcat

Popcat  Helium

Helium  Ethereum Name Service

Ethereum Name Service  GALA

GALA  BitTorrent

BitTorrent  EOS

EOS  ORDI

ORDI  Tokenize Xchange

Tokenize Xchange  NEO

NEO  Akash Network

Akash Network  eCash

eCash

GIPHY App Key not set. Please check settings